M1 Finance

M1 Finance is unlike most online brokerages because it’s like a robo-advisor that also gives you the freedom to self-direct your investments, and that makes it the best of both worlds for investors who want a low-cost way to have it all.

This innovative approach makes M1 Finance stand out, and there’s a bonus of having $0 commissions, trading fees, or advisory fees. With so much to offer investors, it’s worth your time to learn all about M1 Finance’s features, fees, how they compare to other brokerages, and more.

Pros

- No trading fees or commissions

- Flexible and fully customizable portfolios

- Offers fractional shares

- No minimum deposits

Cons

- Not for active traders

- No tax-loss harvesting

- Limited asset types

- Charges inactivity fees

Table of Contents

M1 Finance is unlike most online brokerages because it’s like a robo-advisor that also gives you the freedom to self-direct your investments, and that makes it the best of both worlds for investors who want a low-cost way to have it all.

This innovative approach makes M1 Finance stand out, and there’s an added bonus of having $0 commissions, trading fees, or advisory fees. With so much to offer investors, it’s worth your time to learn all about M1 Finance’s features, fees, how they compare to other brokerages, and more.

M1 Finance Review 2024 – Pros & Cons, Fees, Features, & More

What is M1 Finance?

M1 Finance launched back in 2015 and is an online investing platform that offers investors a highly customizable robo-advisory service. You get a lot of control over the kind of investments held in your portfolio through M1 Finance’s pie system, but this brokerage handles automated trading and portfolio maintenance.

The combination of investor control and automation are incredibly unique in the world of online brokerage platforms, creating a sophisticated investment experience. But M1 Finance also stands out for its nearly non-existent fees. There are $0 portfolio management or trading fees, and no fees for deposits or withdrawals to a connected bank account.

M1 Finance has been growing it’s list of features over the past few years to include an integrated digital banking account with cash sweep features, margin trading, and a financial planning tool called Smart Transfers.

One of M1 Finance’s newest features is called M1 Plus, which is an upgraded subscription service that allows members to earn 1% interest on cash balances, a lower margin rate, multiple trading windows, custodial accounts, and more.

M1 Finance Fees

M1 Finance is known for its low to non-existent fees. There are $0 commissions or trading fees on stocks and ETFs (the only type of assets M1 offers). There are $0 monthly management fees — most automated investment platforms charge close to an annualized 0.25% fee based on assets under management. M1 Finance also doesn’t charge to deposit or withdraw to your connected bank.

There are a few miscellaneous fees you may encounter, including:

- Paper confirms $2

- Paper statements $5

- Inactivity fee after no activity for 90+ days: $20

- Outgoing direct account transfers (moving your assets from M1 Finance to another brokerage without selling): $100

- Wire transfers: $25

Those are just a few of the miscellaneous fees, and what M1 charges is pretty on par with other online brokerages. Although, inactivity fees aren’t very common these days. You will also be charged regulatory fees, which are mandated by the SEC (Securities Exchange Commission) and FINRA (Financial Industry Regulatory Association), and these include SEC and Fee and TAF (Trading Activity Fee). All brokerages are required to charge SEC and TAF fees when you sell a stock or ETF.

M1 Finance margin fees

M1 Finance has a feature called Borrow, which is essentially margin — money borrowed from your brokerage using your portfolio as collateral. You need to have at least $10,000 in assets before you can take out a margin loan. The rate on margin is 3.5% and you can borrow up to 35% of your portfolio’s value.

If you upgrade to M1 Plus, margin rates drop to 2%. You still need at least $10,000 in assets and can only borrow the same percentage of your account’s value.

When you compare M1 Finance’s margin rates to other brokerages, their rates are much more affordable. For example: Fidelity charges 4% to 8.325% and Webull charge margin rates of 3.99%. Robinhood does offer lower rates of 2.5%, but users have to pay $5/month for Robinhood Gold. Interactive Brokers, a much more advanced platform for active traders, has lower rates, from 0.75% to 1.57% if you’re borrowing USD.

M1 Finance Features

Fractional shares

M1 Finance offers fractional shares as a way for investors to start investing with companies for as little as $1. Take a company like Tesla, which has been trading for over $500 in the first quarter of 2024, buying a fractional share gives you the ability to own some of that stock without the $500+ investment.

Types of assets

One of the downsides to investing with M1 Finance is that they only trade stocks and ETFs. Many investors will be fine with those offerings only, but retirement minded investors who want mutual funds or bonds will have to look elsewhere.

Account types

M1 Finance supports individual and joint brokerage accounts, retirement accounts (Roth, traditional, and SEP IRA), and trust accounts. You can rollover an existing IRA to M1 Finance or do a 401(k) rollover. M1 Plus subscribers can open custodial accounts.

Customized investment portfolios

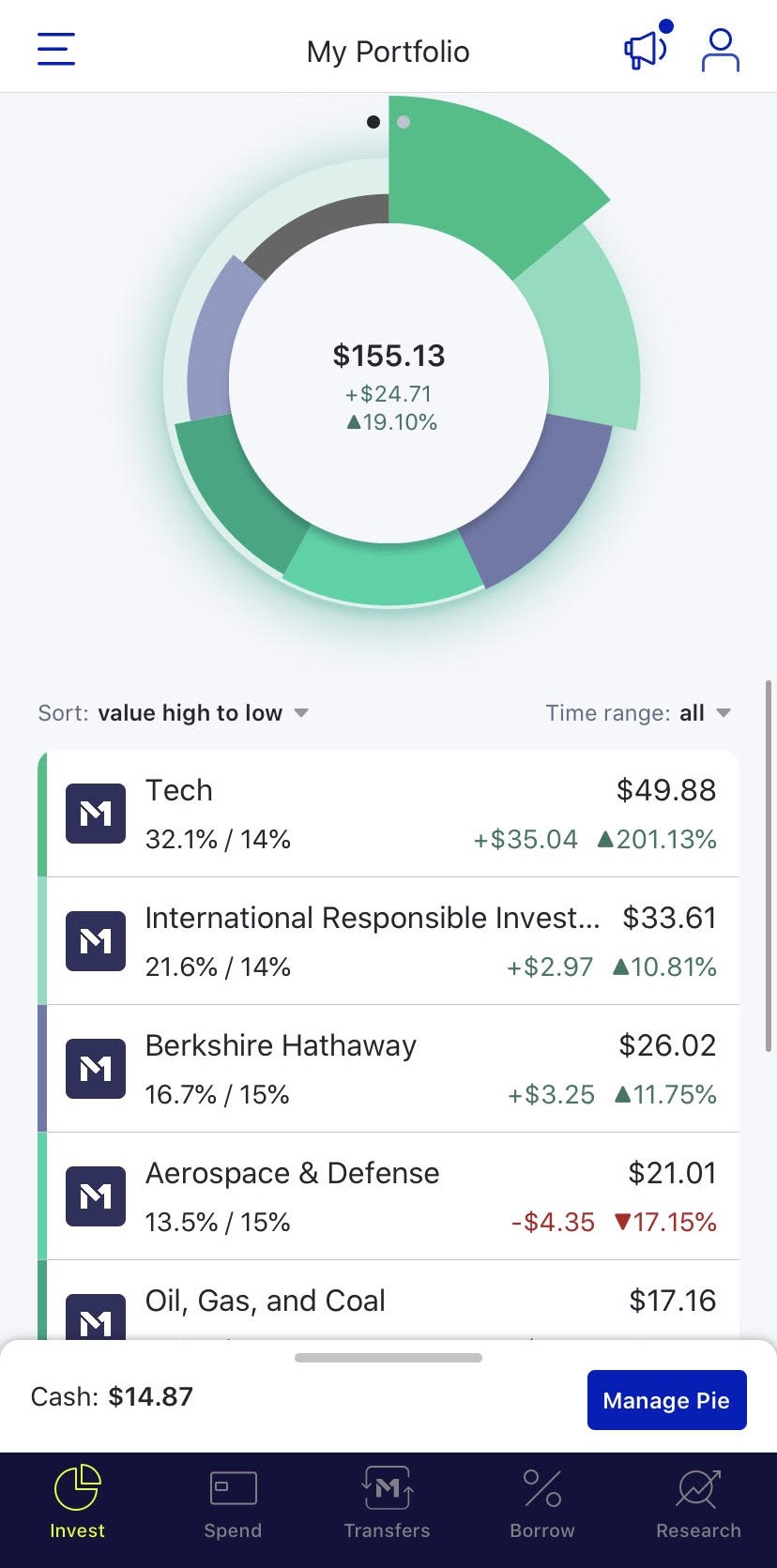

M1 Finance uses a pie structure to help you manage your portfolio, which sounds simple, but it’s a clever way to visualize the asset mix in your portfolio. The whole pie equals your portfolio, and slices of the pie are different stocks or funds.

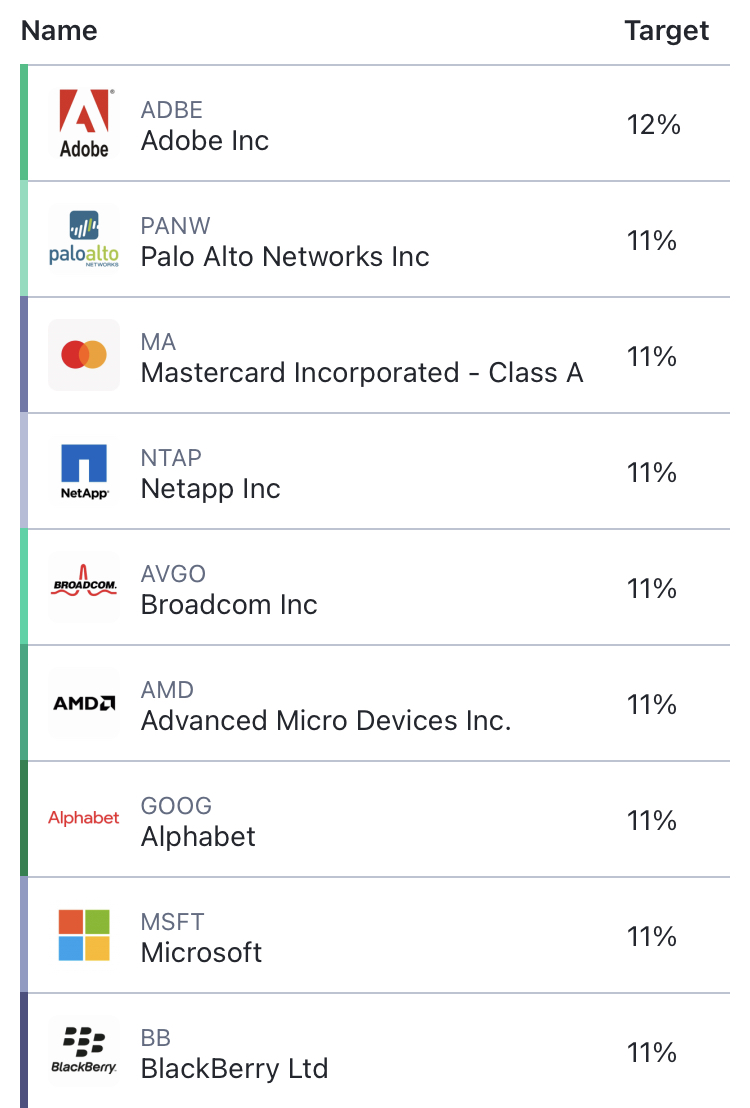

What’s unique about M1 Finance is that you can select one of their over 80 Expert Pies, which are professionally curated portfolios made up of ETFs and stocks. Each of these pies aligns with a different and “generally accepted” investment strategy. You can use of one these Expert Pies, customize it, or build your own.

There are also Community Pies that allow you to invest in companies that share your value and ideals, very similar to the basis for socially responsible investing. So if investing in minority owned businesses is one your priorities, you can invest in the Community Pie for Black-led businesses or LGBTQ+ -led businesses. Below is the list of companies and target allocation in the pie for companies led by AAPI (Asian American Pacific Islander) executives.

Auto-Invest settings

Part of M1 Finance’s automated approach is auto-investing your cash that comes from either deposits or dividends paid to yoru M1 account. The most commonly used setting is “Auto-Invest All My Cash,” meaning M1 will automatically invest your cash balance once it hits $25.

You can also set a minimum cash balance account if you’d like more liquidity. For example, you can tell M1 to keep a minimum of $1,000 in your cash account. The other option is to turn auto-invest off, which lets you place buy orders on specific stocks in your portfolio.

Portfolio rebalancing

Automatic rebalancing is a common robo-advisor feature that involves using an algorithm to buy or sell assets when the asset allocation of your portfolio gets off target. M1 Finance does not do automatic rebalancing — you have to initiate a rebalance.

M1 Finance still has an automated way to rebalance your account that doesn’t require you to initiate it, and this feature is called Dynamic Rebalancing. Basically the assets that are thrown off of your target allocation through natural drift are shored up when M1 Finance makes new trades in your portfolio. That means M1 Finance will first put money towards underweight stocks or ETFs in your portfolio. Dynamic Rebalancing happens when you invest more cash or withdraw from your investment account and sell shares.

M1 Checking Account

M1 Spend is M1 Finance’s integrated checking account, which is entirely optional. Spend is an FDIC-insured checking account that comes with a debit card, there is a $0 account minimum, and you’re reimbursed 1 ATM fee per month.

M1 Borrow

Borrow is M1 Finance’s margin loan feature, which allows you to borrow up to 35% of your account’s equity. Margin is traditionally used as portfolio leverage, but M1 Finance advertises Borrow as a line of credit that can be used in place of a HELOC, personal loan, auto loan, etc. When you think about it in those terms, M1 Borrow has highly competitive rates at 3.5% or 2% if you’re an M1 Plus subscriber. Compared to other online brokerage’s margin rates, M1 Finance is on the lower end, but not the lowest.

What’s also unique about Borrow is that there’s no set payment schedule. You’re charged monthly interest, but you make payments as you see fit. However, if the value of your portfolio declines too much, M1 will force a call for repayment. There’s also the danger that leveraging your portfolio will magnify any losses you experience.

Overall, margin is risky business overall and not for all traders, so make sure you understand it thoroughly before using it.

Borrow is an additional risk, including the risk of losing more than invested. It’s available for margin accounts with $5,000 equity or more, and it’s not available for retirement or custodial accounts. Rates may vary.

M1 Plus

This is M1 Finance’s premium subscription-based service that costs $125/year. New M1 Finance users can receive a free 1-year trial of M1 Plus when they sign up.

Despite the free trial, $125/year sounds fairly steep when you consider it’s over $10/month, but M1 Plus does have some solid features that could make the subscription worth it, like:

- Smart Transfers: Set up automated ITTT (if this, then this) rules that trigger money moving across all of your M1 accounts.

- Lower Borrow rates: M1 Borrow rates drop from 3.5% to 2%.

- Multiple trading windows: You can trade in the morning trading window or the afternoon one, and investors with more than $25,000 equity in their portfolio can trade during both windows.

- High-interest rate checking: M1 Plus users get 1% APY on the cash held in checking, which is 33x over that national average APY for checking accounts at 0.03%. No minimum balance to open account. No minimum balance to obtain APY (annual percentage yield).APY valid from account opening. Fees may reduce earnings. Rates may vary.

- Cash back rewards: Earn up to 1% cash back on qualifying purchases with your Spend debit card.

- ATM reimbursements: You’re reimbursed for 4 ATM fees each month on your M1 Finance checking account compared to 1 with Basic.

M1 Finance customer service

M1 Finance has two customer service options. You can file a support ticket through the app or desktop platform, and wait for one of their customer service support members to get back to you. Or you can call M1 customer service directly during U.S. stock market hours: Monday through Friday from 9:30 a.m. to 4 p.m. EST.

The M1 Finance customer support phone number is 312-600-2883.

Alternatives to M1 Finance

This has been brought up several times already in my M1 Finance review, but M1 Finance is a pretty unique investment platform. It’s like a robo-advisor for people who want to self-direct their investments. I bring this up because it’s hard to make any direct comparisons with alternatives, still, let’s take a look at two competitors:

M1 Finance vs. Robinhood

Both online brokerages charge $0 commissions, but Robinhood offers more asset types, including stocks, ETFs, options, and cryptocurrency. That’s a lot compared to M1 Finance only offering stocks and ETFs.

You will need to pay $5/month for a Robinhood Gold account to access margin, and Robinhood gives you the first $1,000 of margin free. Their rates are lower too — a flat 2.5% compared to the 3.5% rate you’ll pay with M1 Finance Basic.

Robinhood is better suited for active traders who want full control over their account and more asset types.

M1 Finance vs. Betterment

Betterment is one of the original robo-advisors, and it’s a great investment platform for goal-oriented investors. Betterment charges an annualized fee of 0.25% of assets under management, which include a full-service, passive investment experience. Betterment recommends an asset allocation for you, does automatic rebalancing, and lowers your tax liability with tax-loss harvesting.

There are some similar automated features with M1 Finance and Betterment, like auto-invest and rebalancing, but Betterment is ideal for investors that want to be fully hands-off.

M1 Finance Pros and Cons

Pros

- No trading fees or asset management fees

- Flexible portfolio building that gives you expert advice while allowing for customization

- Fractional shares mean you don’t have uninvested cash

- No minimum initial deposit

Cons

- No tax-loss harvesting, which is offered by many automated services to offset capital gains made when assets are sold

- Not for active traders, even though you can select your investments, M1 Finance isn’t an active trading platform

- Limited asset types, you can only purchase stocks and ETFs

- Charged an inactivity fee after 90 days of no trades

M1 Finance Review: The Final Word

M1 Finance is doing a great job at standing out in an increasingly crowded market. It wants to be both an automated investment platform and one that gives you as much control as possible, and it actually does both of those things pretty well.

Active investors will want more freedom and investment types than M1 Finance has to offer (check out this list of Robinhood alternatives for options). But buy-and-hold investors can have a unique experience with M1 Finance. When you remember that M1 charges $0 trading fees, commissions, or account fees, M1 Finance is a solid choice for reaching your investment goals.

FAQs

Whenever a brokerage is free, it begs that question. M1 Finance, like other free brokerages, makes money in several different ways:

– Interest on cash: They lend out uninvested cash and earn interest on it

– Interest on lending securities: M1 Finance lends out securities owned on the platform and earn interest on those securities

– M1 Borrow: This is M1 Finance’s margin feature, and borrowers pay monthly interest of 2% to 3.5%

– Cash and interchange on M1 Spend accounts: M1 Finance earns interest on uninvested cash in your M1 checking account, and they receive a small percentage of the transaction fee when you use your M1 Spend debit card

– M1 Plus membership fee: A $125/year subscription fee for premium services

– Payment for order flow: A somewhat controversial, yet widely used, practice that involves earning commission from directing orders to third-party services for execution.

M1 Finance is transparent about how they make money, and it’s similar to how Robinhood makes money if you want to learn more.

M1 Finance is a safe and legitimate investment platform that has over $4 billion in assets under management. It’s smaller and newer than brokerages like Charles Schwab, Fidelity, or Vanguard, but it’s still a safe way to invest your money.