This Stash review includes updated features and pricing for 2024.

Whenever I talk to people who haven’t started investing, they usually have a few reasons why.

“I don’t feel like I’ve got enough money to make a substantial investment.”

“Investing sounds really confusing.”

“I don’t know how I would pick my investments.”

With Stash, you can start investing with as little as $5. The app is easy-to-use with strong educational content. Stash offers themed ETFs, so you can invest in areas and companies with goals and ideals that match your own.

Stash is breaking down the barriers built by traditional investing, but is it the best way to invest your money?

Table of Contents

- What is Stash?

- Stash Fees and Pricing

- 5 Steps to Start Investing With Stash

- How to Continue Investing With Stash

- Thematic Investing With the Stash App

- Stash Retirement Accounts

- Stash Banking Account & Stock-Back Card®

- Learning to Invest With Stash

- The Downside of Investing With Stash

- Is Stash legitimate?

- Stash Review — Pros and cons

- Alternatives to Stash

- Betterment

- Acorns

- The Final Word on Stash

- FAQs

What is Stash?

Launched in 2015, Stash was created to “make investing easy and affordable for everyone.” The founders of Stash recognized a problem that traditional investing platforms and companies weren’t accessible for the majority of Americans.

Stash wants to take down the barriers to traditional investing – cost, level of difficulty, and just being out of touch with everyday folks.

To remove those barriers, Stash is a micro-investing app which means you can invest with very small amounts of money, literally spare change. Instead of buying full shares of stocks or ETFs, you are investing in fractional shares.

Not only can you start investing for $5 or less, but Stash also helps you choose which investments to add to your portfolio, or you can add investments to your portfolio based on your interests and values.

Stash has personal brokerage investment accounts, retirement accounts, custodial investment accounts for your children, and online banking. It’s also rich in educational content to help you learn as you go.

All of this sounds really good, but my Stash review is going to dig into specifics to help you decide if Stash is worth it or not.

Stash Fees and Pricing

Stash has three different monthly subscription plans starting at $3/month.

- Growth – $3/month. This plan includes a personal investment account, unlimited trades, online banking1 with access to the Stock-Back® card2, financial education, a tax-advantaged retirement account, and a $1,000 life insurance policy offered through Avibra3.

- Stash+ – $9/month. Includes everything in Growth plus custodial accounts for up to two children. You’ll receive a monthly market insights report, a Stash debit card with 2x Stock-Back®,4 and a $10,000 life insurance policy through Avibra.3

These are flat monthly fees, unlike a percentage of AUM (asset under management) that traditional brokerages charge.

If you’ve been researching micro-investing apps, Stash fees are comparable to Acorns for the first two options Beginner and Growth.

Acorns’ top tier plan is only $5/month compared to Stash’s $9/month. Stash’s $10,000 life insurance plan is a major difference between the two apps.

Improve your financial life today

Stash is an all-in-one app for budgeting to saving for retirement, and even includes features for banking and investing.

5 Steps to Start Investing With Stash

The Stash app is known for offering a really positive user experience. Signing up and starting to invest is simple, takes just a few minutes, and the app walks you through it all.

Step 1: Click Here to Sign Up for Stash

You sign up for Stash using your email address and create a secure password.

Step 2: Fill Out Your Stash Investment Portfolio

When you sign up for Stash, you’ll need to share your name and birthday, Social Security number, employment information, annual income, and net worth.

This is the same kind of information that any other investing app is going to ask for. It helps Stash determine whether your risk tolerance is conservative, moderate, or aggressive. This is how Stash recommends investments.

Step 3: Pick Your First Investment

Based on your risk tolerance, Stash will recommend a first investment that matches your risk tolerance.

For example, if Stash recommends a conservative portfolio, they’ll show you conservative investments. You can look at the investment’s historical performance and price, and if it is an ETF (exchange-traded fund), you can scroll down to see which assets it includes.

If you want to invest in it, just click that big “Buy” button at the bottom of the screen.

Stash organizes its ETF investment options based on themes, like Clean and Green (energy sources like solar and wind), Social Media Mania (social media companies) or Home Sweet Home (American home building firm). You’ll see the cost, history, and what’s in each ETF.

Further down in my Stash review I’m going to explain the way Stash names and organizes these thematic investment options. It’s pretty unique and very approachable for new investors.

Step 4: Add Your Funding Source

Your funding source is your external bank account. You connect it to your Stash account so you can complete your first investment.

Stash will pull funds from your linked bank account to purchase each investment, and you can connect a different funding source whenever you want.

Step 5: Confirm Your Identity

Stash sends an email to the account you used to sign up, and you will need to click on that email to verify who you are and finalize everything. You’ll also be asked to create a 4-digit pin that you’ll use to log into your Stash app.

How to Continue Investing With Stash

Investing regularly is one key to a healthy investment strategy, and Stash automates routine investments in many different ways: Set Schedule, Round-Ups, DRIP (dividend reinvestment program), and Stash’s Stock-Back® card.

Set Schedule

Scheduling deposits into your Stash account is a fast way you can grow your balance. You decide how much you want to transfer into your Stash account and if you want to do that on a weekly or monthly schedule.

Stash saves transferred funds as a cash balance that still needs to be invested. But you can eliminate that step by setting a schedule for individual investments.

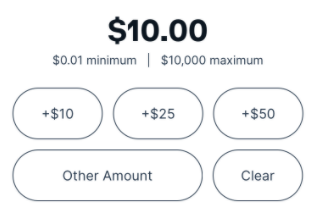

You tell Stash how much of each ETF or stock to buy and when, and then Stash automatically purchases them for you on a schedule. You can see an example of that below:

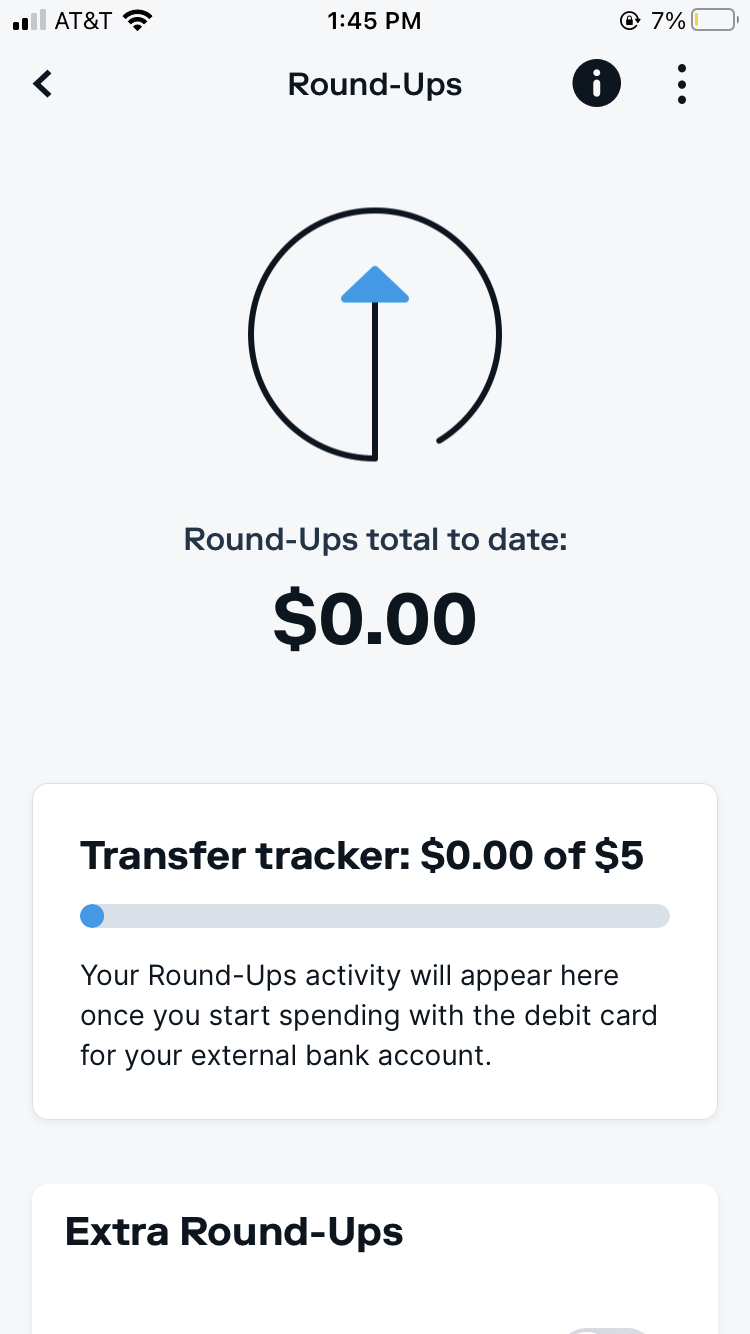

Round-Ups

Round-ups are unique to the world of micro-investing and micro-savings apps, and it’s also known as spare change investing.

Investing with Stash Round-Ups works like this: any time you make a purchase with the debit card that’s attached to your linked account, Stash rounds that transaction to the next dollar amount and when that amount reaches $5 or more, Stash transfers that balance to your invest account making it available for you to invest.

Here’s an example: spend $4.37 on a latte, Stash will round that up to $5, and hold the $0.63 difference until it reaches $5 total. You can pick how to invest your Round-Ups once it’s transferred to your personal invest account.

You can track your Round-Up balance in the Stash app, and you can also pause Round-Ups whenever you want.

DRIP (Dividend Reinvestment Program)

For investments that pay dividends, you can opt in to this program to automatically reinvest dividends back into more shares of the same investments. This can help you build your long-term growth and returns. Remember, not all stocks pay out dividends. And there’s no guarantee any stock will pay dividends in a quarter or year. Dividends may be subject to additional taxes, and are considered taxable income. Please refer to the IRS for additional information.

Stash Stock-Back® Card2

Each Stash subscription type lets you set up an online banking account through Green Dot bank. Then Stash will send you the Stock-Back® Card once you deposit at least $1 into the banking account balance.

You can earn stock with every purchase you make with Stash’s Stock-Back® Card.2 It’s similar to earning credit card rewards points, except you’re given a micro-share of a stock or ETF instead of points. A little further down in my Stash review, you’ll learn more about how the Stock-Back® Card works.

Thematic Investing With the Stash App

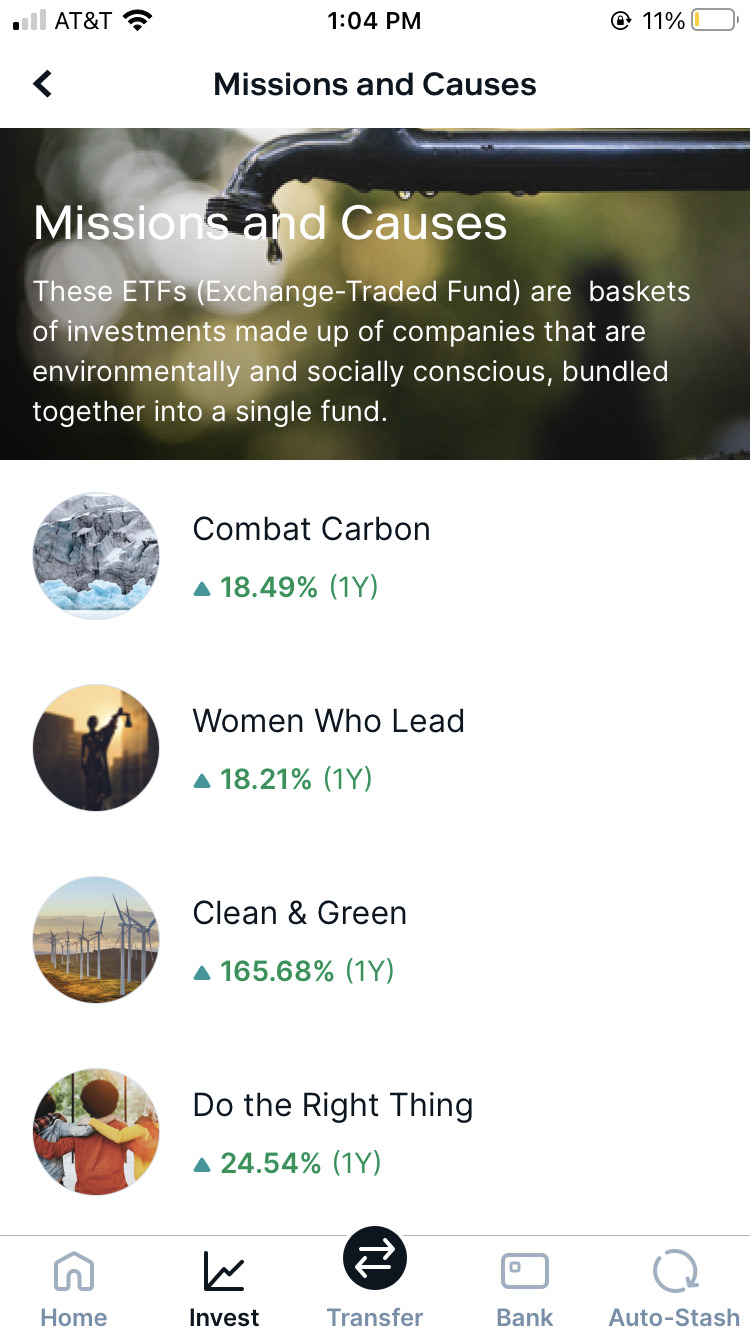

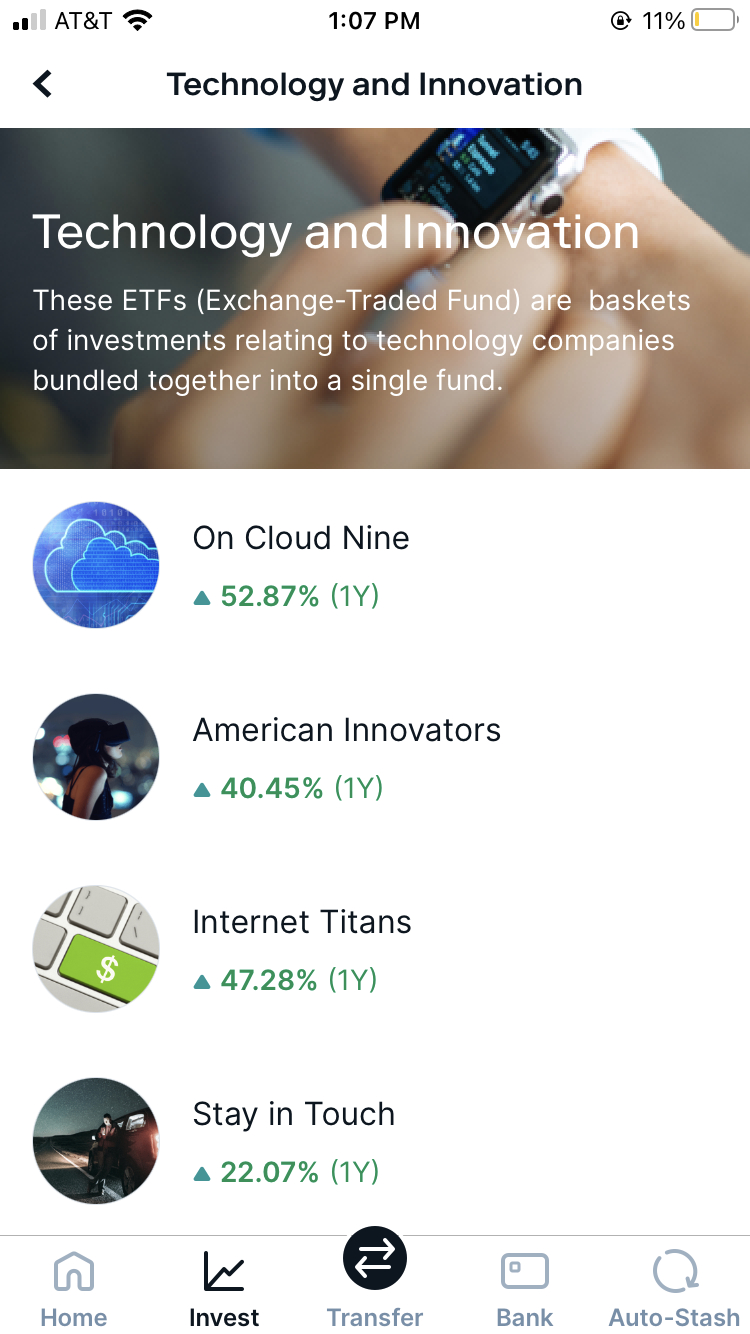

What Stash has become so well-known for is thematic investing. This is unique to Stash, and it’s a beginner-friendly way to browse for investments.

Interested in investing in the tech industry or socially and environmentally conscious companies, there’s an easy way to find those investments.

You can see in those screenshots that Stash gives you a name for each investment and performance over the past year. The names aren’t the official names for each ETF – Stash rebrands existing ETFs to make them easier to understand.

For example, the official name of Combat Carbon is iShares MSCI ACWI Low Carbon Target ETF, ticker symbol CRBN. And, the official name for Internet Titans is First Trust Dow Jones Internet Index Fund, ticker symbol FDN.

You can see how these themed names are much easier to digest.

Below are a few more themed investments offered by Stash:

- American Innovators (U.S. based tech companies) is the Stash name for Vanguard Information Technology ETF, ticker symbol VGT

- Women Who Lead (female-focused companies, leadership, and charitable work) is the Stash name for SPDR SSGA Gender Diversity Index ETF, ticker symbol SHE

- All That Glitters (precious metals) is the Stash name for Aberdeen Standard Physical Precious Metals Basket Shares ETF, ticker symbol GLTR

- Do the Right Thing (companies who focus on positive environmental, social, and/or governance impact) is the Stash name for iShares MSCI USA ESG Select Fund, ticker symbol SUSA

- Data Defenders: (cybersecurity companies) is the Stash name for First Trust NASDAQ CEA Cybersecurity ETF, ticker symbol CIBR

Stash gives you a lot of information about each ETF, from exactly what’s in each fund, expense ratio, dividend yield, when the last dividend was paid, etc. There’s also a link to each fund’s website if you want more information that Stash investing gives you.

Besides making it easier to understand what you’re investing in, thematic investing also introduces you to what’s referred to as socially responsible investing (SRI) or ESG investing (environmental, social, governance).

Both are the practice of investing in companies that exemplify your social, environmental, or governance beliefs.

To meet that interest, even big investment firms like Charles Schwab and Vanguard have created funds and options to financially back your beliefs.

Related: Top 23 Legit Money Making Apps to Download For Your Smartphone

Stash Retirement Accounts

With either Stash plan, you can set up and invest in a Roth or Traditional IRA. These are tax-advantaged retirement funds.

Stash will track your progress towards reaching the maximum IRA contribution limit – for 2021, the limit is $6,000 for anyone under 50, and $7,000 if you’re 50 or older.

Retirement investors can use Stash’s retirement calculator to get an estimate of how much you’ll need to save to retire, and you can automate your retirement contributions with Auto-Stash (scheduled deposits into your investment account).

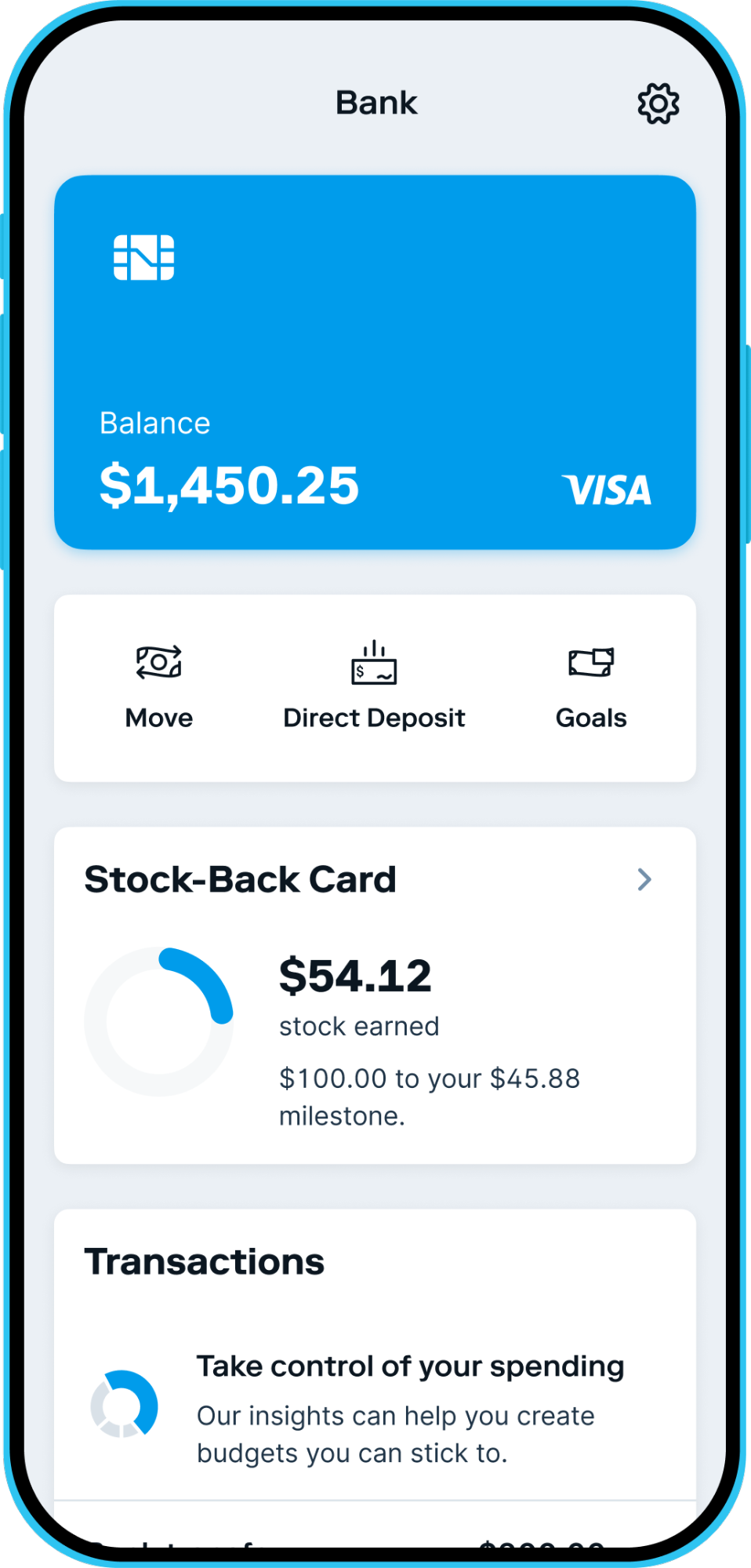

Stash Banking Account & Stock-Back Card®

Stash partnered with Green Dot Bank to provide FDIC-insured checking account, and banking access comes with all of Stash’s plans. It’s an online banking account with zero overdraft fees, monthly maintenance fees, minimum balance fees, and there is access to thousands of fee-free ATMs.5

The idea is that having your bank account and investment account held in the same place means you’re simplifying things. Think of it as fewer places to check.

Stash’s banking account also offers holistic financial advice so you can address issues related to spending, saving, and investing.

However, the real benefit to using Stash’s banking account is that you can enroll in Stash’sStock-Back® rewards program. This is a rewards program where you earn pieces of stock back when you use your Stash branded debit card to shop.

For example, if you use your Stock-Back® card to make a purchase from Amazon, Stash rewards you with a small percentage of Amazon stock back. You earn stock back on every purchase you make with this card, even if the company isn’t publicly traded.

Say you make a purchase at a local restaurant, Stash will reward you with a fractional share of an ETF that you can choose from a list provided by Stash.

During certain time periods, you can potentially earn up to 2% Stock Back ® from some of your purchases. Stash investors enrolled in the Stash+ plan can earn 2x back on their purchases with the Stock-Back® Card.4

Learning to Invest With Stash

One of the areas that Stash shines is that it teaches new investors how to invest. Next to the perceived high cost of investing, a lack of knowledge prevents a lot of new investors. The Stash investing platform actively works to break down this barrier.

This educational component is extremely important if you’re picking your own investments, and Stash gives you more control over your investments than the popular Stash alternative, Acorns.

Below are ways the Stash investment app teaches you to invest:

1. Easy access to important information about your investments

For each investment, you can look at the dividend yield, performance, and expense ratio for ETFs. You can also click on a button on any investment and be taken to that investment’s website where you can do even more research.

2. Learning center

Stash Learn is Stash’s collection of articles and how-to guides that cover topics like investment basics, national and global money news, personal finance issues, etc. Some of the most recent articles include a guide to the 2024 tax season, starting to invest in legal cannabis, and what you need to know about free credit score apps.

The Downside of Investing With Stash

This has probably sounded like a glowing Stash review, and I honestly think they’re doing a great job introducing new investors to the market by breaking down those barriers I mentioned at the beginning of this review: cost, difficulty, and approachability.

However, and this one is big, Stash can be a surprisingly expensive alternative to traditional brokerage.

I know $3/month may sound inexpensive, but when you only have $100 invested, you’re being charged a 1% fee, which is high for brokerages that charge a percentage of assets under management, or AUM. For example, Betterment has a 0.25% annual fee.

As your account balance grows, paying a flat fee can be much more cost-effective, but if you’re relying on spare change investments alone, it will take a long time to get to that break-even point.

We’ve started seeing more and more traditional brokerage doing away with account management fees for personal brokerage accounts and IRAs. Schwab and Fidelity don’t have opening or maintenance fees. Vanguard charges a $20 fee to open a brokerage account, but they’ll waive it if you sign up for their e-delivery service.

The other reason investing with Stash can be more expensive is because when you pick your own investments, you can wind up investing in funds with pretty high expense ratios.

Expense ratios are what the investment company (who created the fund) charges to maintain and operate the fund.

Stash’s average expense ratio is about 0.24%, and that’s marginally higher than other online brokerages like Vanguard. There are some ETFs with much higher expense ratios, like BLOK (an ETF for companies that are developing and utilizing blockchain technology). BLOK’s expense ratio is 0.70%.

There’s also some debate about the long-term effect that socially responsible investing can have on your portfolio. While more and more evidence suggests you can see the same kind of positive growth, there are still concerns that you’ll end up leaving some great investments on the table because you’re less focused on growth. You can follow the Stash Way by diversifying your portfolio and not putting all of your eggs in one basket.

In the end, you can decide if you want to make this part of your investment strategy. You can weigh up the differences and make the right choice for you.

Is Stash legitimate?

Stash is a registered investment advisor with the SEC, which requires that Stash follows federal regulations to protect consumers. Your investments are held by Stash’s partner and custodian Apex Clearing Corporation, a third-party SEC registered broker-dealer and member FINRA/SIPC. Stash has partnered with Apex Clearing Corporation to hold and protect your investments up to $500,000 (including 250,000 for claims for cash). For details, please see www.sipc.org. For uninvested funds, your Stash account is enrolled in something called the Apex FDIC-insured Sweep Program. Deposits to the Sweep Program are covered by FDIC insurance up to $250,000 limit per customer at each FDIC-insured bank that participates in the Sweep Program. Once your cash is deposited with the participating banks under the Sweep Program, such cash will no longer be covered by SIPC. Learn about the FDIC Sweep Program.

Stash is also PCI DDS compliant, meaning it’s regularly audited by an external third party to make sure that all technical controls and card data is protected.

Here are a few more security features you get with Stash:

- 256-bit encryption

- Bug bounty program

- Transport Layer Security

- Optional biometric recognition

- Access controls like end-times, log-in thresholds, and two-factor authentication

Stash Review — Pros and cons

Stash shines for several different reasons, but there are also a few things that might not make it a good fit for you.

Pros

- You can start investing with as little as $1.

- You can invest in fractional shares of stocks and ETFs – fractional shares of stocks is unique to Stash.

- Investors can invest in companies that match their interests and values.

- Strong educational content and support.

- You can receive a $5 bonus after you deposit at least $5 into your Personal Portfolio by signing up for a Stash account by using Stash.

Cons

- Does not include tax-loss harvesting and automatic rebalancing (unless you’re using Smart Portfolio).

- The subscription fee is slightly higher than other micro-investing platforms and robo-advisors.

- You’re potentially paying higher expense ratios, especially if you pick your own investments.

Alternatives to Stash

Stash should be a strong contender for new investors, and it has features that are unique to Stash — themed investments and micro shares of stocks. Stash also has more educational content than many other investment apps. But if you’re interested in looking at other options, here are two more M$M picks.

Betterment

Betterment is a robo-advisor that has personal investment accounts, retirement accounts (Traditional and Roth IRAs and 401(k) rollovers), and cash savings. Betterment offers daily tax-loss harvesting, access to a tax impact tool, and extended portfolio options.

Betterment has two levels of service: Betterment Digital is 0.25% annually or 0.15% once your account hits $2 million, and Betterment Premium is 0.40% annually ($100,000 account minimum) or 0.30% once your account hits $2 million. Premium includes unlimited access to Betterment’s Certified Financial Planners.

Acorns

Acorns is part micro-investing app and part robo-advisor. You can fund your account with Round-Ups, Found Money, and Multipliers. There are five different pre-built account types to match your risk tolerance.

Like Stash, Acorns has a two-tier price structure, from $3-$5/month, but it lacks the strong educational content you get with Stash.

Learn more at Acorns vs. Stash: Which Is Better, How Much They Cost, and Should You Use Them?

The Final Word on Stash

All in all, Stash has an easy to use platform that makes investing interesting and approachable. All of those carefully curated ETFs show you that you can back your beliefs with cash. They have a decent amount of educational content too.

Add all of those things up and Stash is an intuitive investment app that’s good for beginners.

- With automated deposits, you can get into a habit of investing.

- The focus on small deposits shows you that you don’t need a ton of money to start investing.

- Stash’s millennial-friendly collection of ETFs can make investing exciting.

I’ve voiced my concerns about the costs associated with Stash, and they are worth considering. However, if Stash is what you need to finally start investing, I’d say it’s worth it overall. Get started with Stash today and receive a $5 bonus after your first deposit of at least $5 into your Personal Portfolio.

Improve your financial life today

Stash is an all-in-one app for budgeting to saving for retirement, and even includes features for banking and investing.

FAQs

Yes, you can make money with Stash. It’s like any other legitimate investing platform. If what you’ve invested your money in does well, then you can make money from it. And like any good brokerage, Stash acknowledges the risks associated with investing.

DiversyFund is much different from Stash – it’s crowdfunded real estate investing. However, DiversyFund is unique in that world because they own and manage property directly instead of acting as a broker, which is why they don’t charge account management fees.

Crowdfunded real estate is a very illiquid investment compared to investing with Stash, and DiversifyFund offers fewer options than some of its competitors.

Both Robinhood and Stash offer micro shares of stocks and ETFs, and both are commission-free trades. Where they differ is that Robinhood has $0 fees, unless you want Robinhood Gold for $5/month.

Robinhood Gold comes with investing on a margin, professional research, and level II market data. It’s like supercharging your investments.

Robinhood also trades cryptocurrency, but it’s a much more hands-off micro-investing platform. It’s better for people who feel comfortable on their own.