Whenever my readers want to help to find the best personal finance tools, one of my top picks has always been Personal Capital. Many of you may already be using Mint, YNAB, or EveryDollar, but Personal Capital has additional tools and functions that make it the best choice in 2025 to organize your financial life.

The first thing to know is that Personal Capital is free, but because they make their money providing wealth management services to high net worth individuals, free users are able to take advantage of powerful tracking tools. More on their wealth management and investment services farther down.

But, let’s talk about that free thing for a second. You should always be skeptical when something in the personal finance world is free – there is a lot of bogus stuff out there, but Personal Capital isn’t one of them, guaranteed. You don’t even get the third party ads as you do with Mint.

M$M tip: See how they compare, Personal Capital vs. Mint: Which One is Right For You?

Overall, Personal Capital is a well-rounded personal tool that focuses on helping you plan for retirement, but it can also help you with your day-to-day planning like budgeting.

Use the exclusive M$M link to learn more and sign up for Personal Capital.

Table of Contents

- About Personal Capital

- What Personal Capital Offers In 2025

- Your Personal Capital Dashboard

- Using Personal Capital’s Dashboard Tools

- Net Worth Tool

- Cash Flow Analyzer

- Budgeting With Personal Capital

- Using Personal Capital in 2025 to Help You Plan for Retirement

- Retirement Planner

- Portfolio Performance

- Retirement Fee Analyzer

- How to Sign Up for Personal Capital In 2025

- You Have to Link Everything To Get a True and Accurate Picture of Your Finances.

- Using Personal Capital for Wealth Management

- Additional Personal Capital Features

- Pros and Cons of Using Personal Capital

- The Final Word on Using Personal Capital In In2025

About Personal Capital

Personal Capital was founded in 2009, and since then, over two million people have started using Personal Capital to track their assets, budget, and help them plan for retirement. There are around 19,000 clients using their wealth management program, which pairs the Robo-advisor model with human support. They currently have over $9 billion in assets under management.

The company describes itself as “A whole new way to manage your money,” and that statement is entirely true because it does something that many free personal finance tools don’t – it has a heavy focus on retirement, from helping you save on fees to tracking your progress.

What Personal Capital Offers In 2025

This review is going to primarily focus on the free version of Personal Capital because that’s what most people will be interested in using, but there is a quick look at their Wealth Management services towards the end.

Your Personal Capital Dashboard

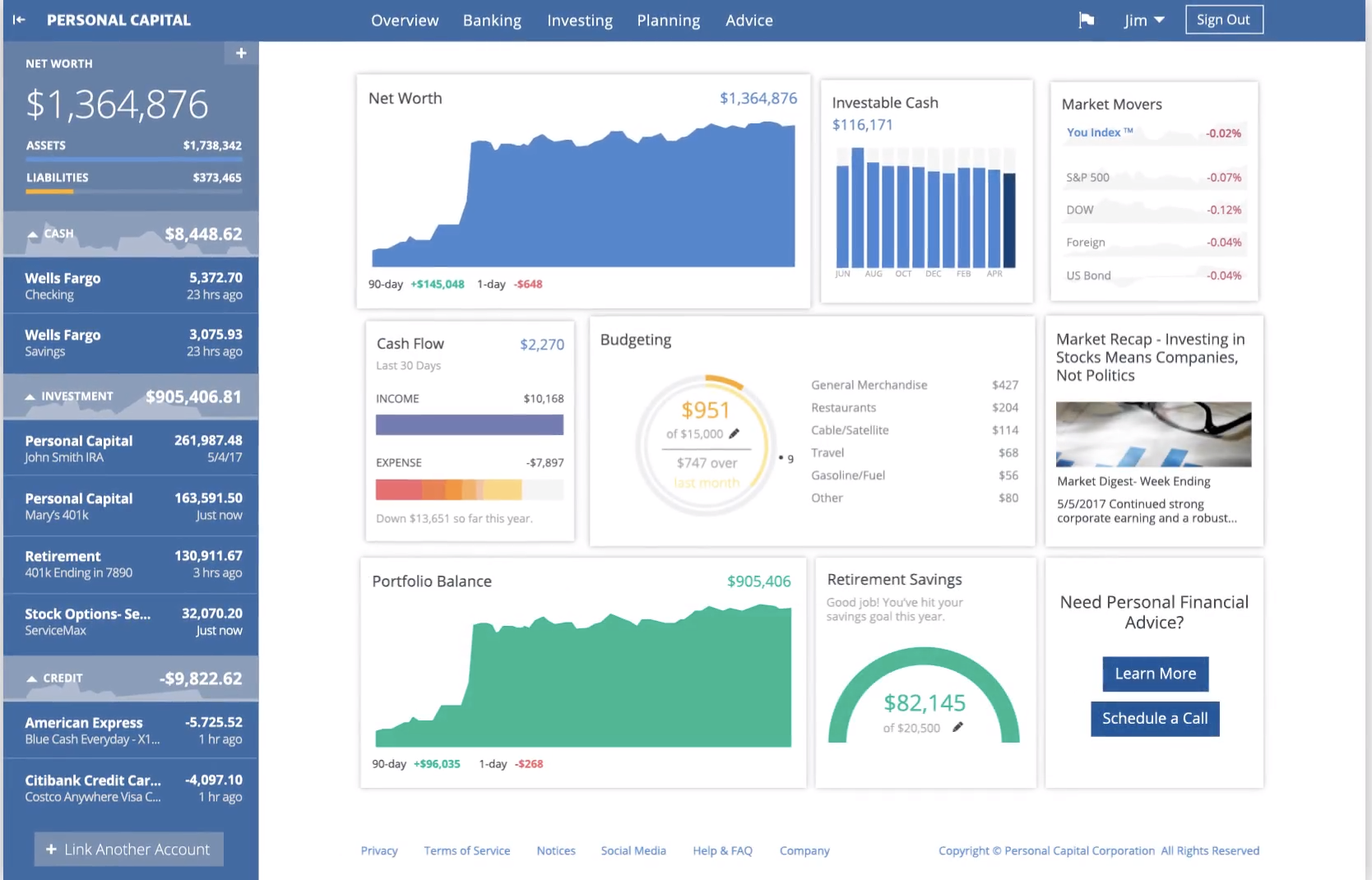

After you log in to your free Personal Capital account, your dashboard is going to be the landing page that gives you a broad overview of your finances, including:

- Net worth

- Investable cash

- Cash flow

- Budgeting

- Portfolio balance

- Retirement savings

There is also a sidebar on the left of your screen that starts with your net worth (written larger than anything else on the screen because it’s so important) broken down by assets and liabilities. The sidebar also shows information about any of your linked accounts – how it calculates your net worth – from cash in checking, investments, loan details, credit cards, etc.

Using Personal Capital’s Dashboard Tools

You can click on any of the boxes on your dashboard to see a more detailed picture of each area. But, let’s take a closer look at why some of these tools are important so you can see how Personal Capital can help you manage your finances in 2020.

Net Worth Tool

Your net worth is calculated by taking all of your assets minus your liabilities. You can choose to look at where you’re currently at, the past 30 days, past 90 days, etc. You can even break this down by asset/liability class, like credit, cash, investments, loan, mortgage, etc.

The reason Personal Capital prioritizes your net worth is that it determines your overall financial strength.

Cash Flow Analyzer

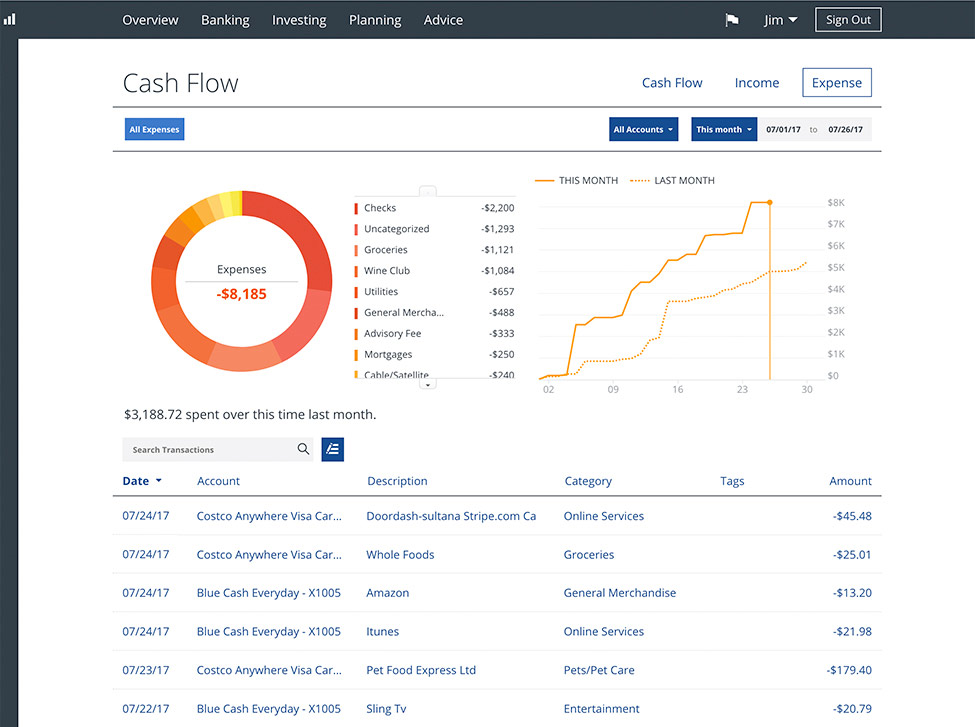

If you click on your cash flow, you’ll get a better understanding of how you spent your money over the past month. There is a detailed graph, but you can also see transactions from any of the accounts you link.

Each transaction is broken down into different budgeting categories, and you can even add tags to help you organize things the way you like them.

Budgeting With Personal Capital

To be completely honest with you, there may be some other budgeting apps that focus more heavily on helping you build and stick to a budget. But, that isn’t to say that Personal Capital can’t help.

Once you’ve linked your accounts, the cash flow analyzer creates a budget that’s shown on your dashboard. It lists the categories you’ve spent in throughout the month, how much you’ve spent, and if you are over or under budget – this helps you stay on track for your bigger goals.

Using Personal Capital in 2025 to Help You Plan for Retirement

This is where Personal Capital shines over any other free personal finance software out there, and it’s honestly why I use this software on a daily basis to keep track of my finances. Let’s break down Personal Capital’s robust set of investment and retirement planning tools.

Retirement Planner

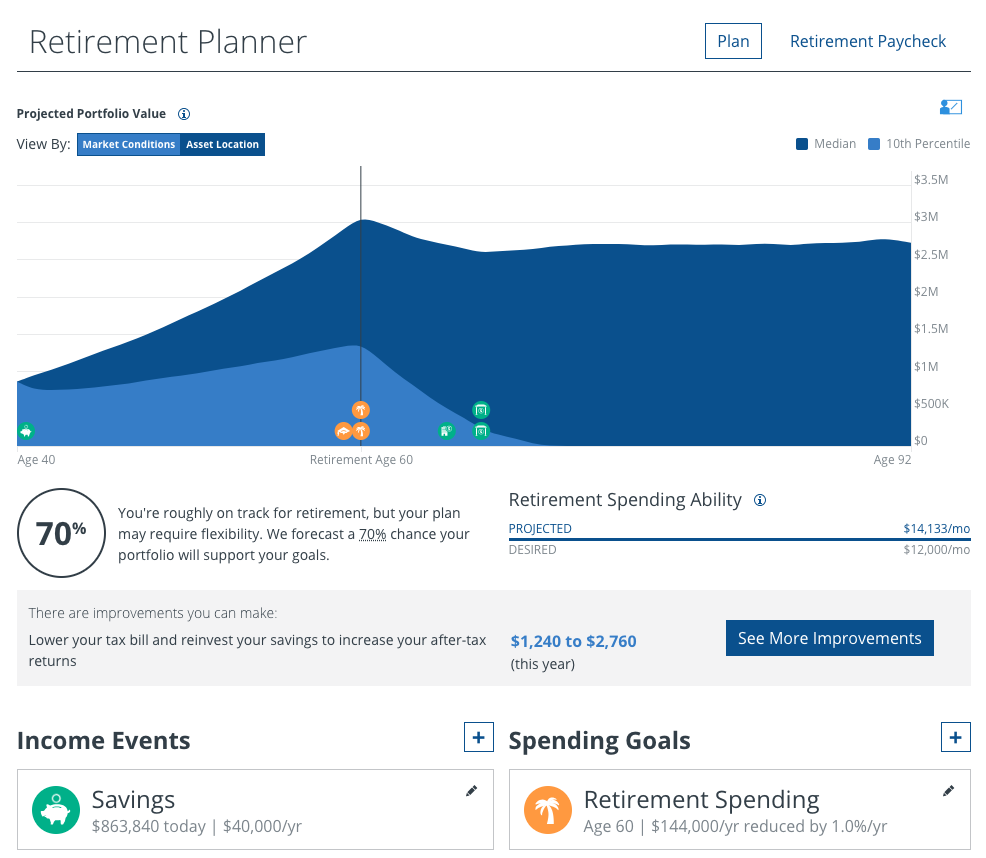

Your retirement planner pulls information from all of your connected accounts, asks about your projected savings information, current retirement savings, your age, and planned age of retirement to tell you whether or not you’re on track.

You can actually play around with some what-if scenarios (job change, having kids, saving for college, etc.) to see how each situation may impact your projected retirement age and savings. If your retirement goals look like they won’t quite work with your current or prospective financial picture, Personal Capital will give you some suggestions for getting on track.

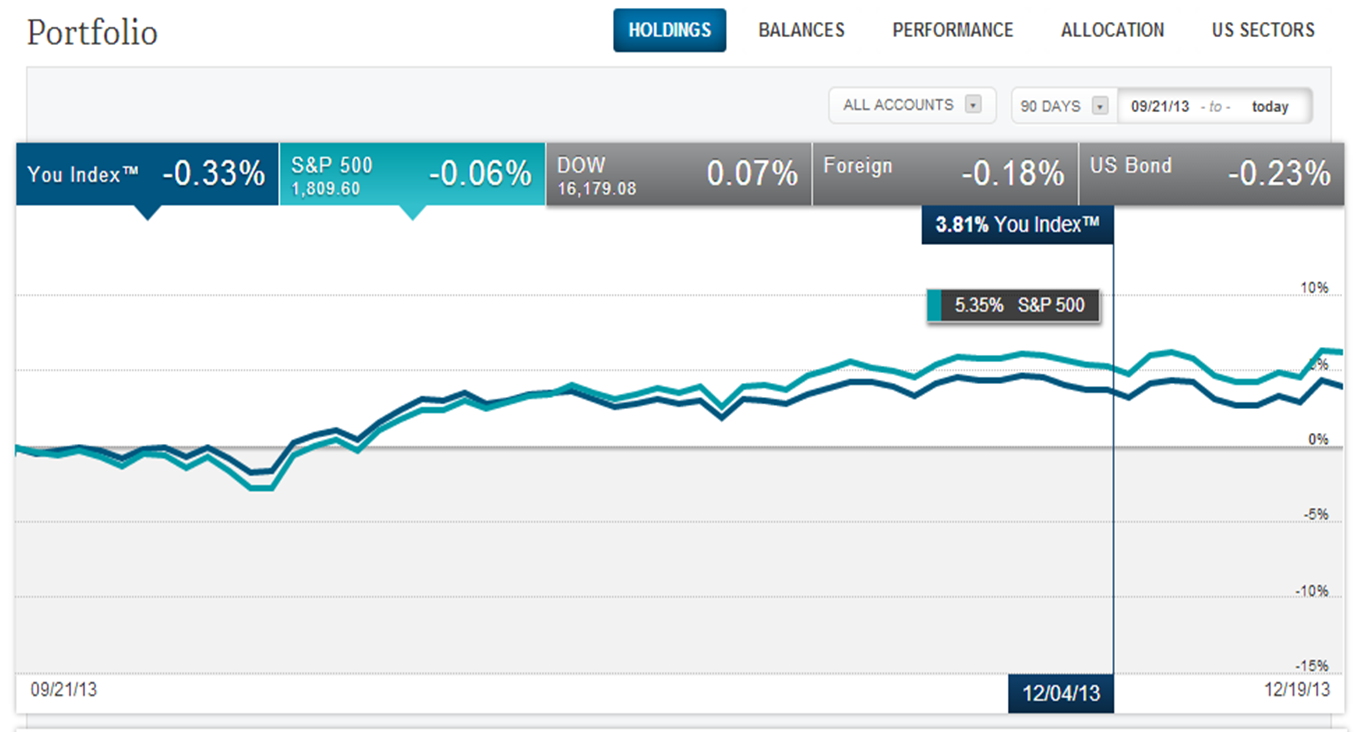

Portfolio Performance

This is essentially a check-up on your investment portfolio. Personal Capital looks at where you’ve invested your money to ensure that you’re optimizing your investments. If you aren’t, they will recommend a better mix of investments to shore up your portfolio’s long-term health.

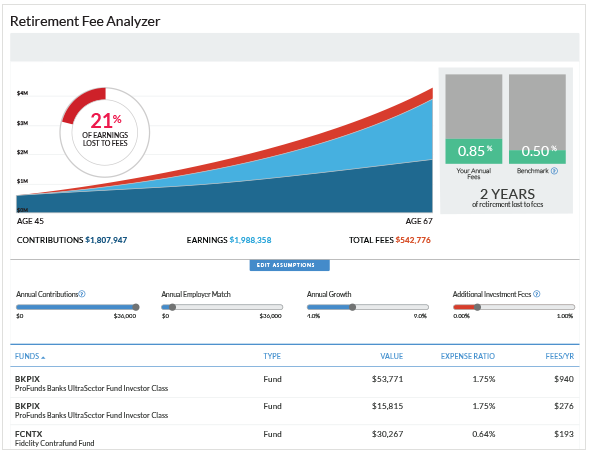

Retirement Fee Analyzer

Ahhh… this is a super cool tool that can actually save you thousands or even hundreds of thousands of dollars as you plan for retirement.

Here’s why the Retirement Fee Analyzer is so helpful: many investment funds, from ETFs, mutual funds and 401(k)s come with expense ratios and/or hidden fees. Depending on the rates and how fees are charged, the smallest percentage difference can result in you either saving or keeping a significant amount of your money.

Personal Capital’s Retirement Fee Analyzer shows you how those fees affect your overall investments. There are tools to slide those fees up to and down by tiny percentage points to show you the impact on your retirement savings.

The analyzer also lets you adjust:

- Earnings

- Contributions

- Annual growth

- Employer matches

- Additional investment fees

- Projected retirement age

With each adjustment, you’ll get a better understanding of you where you stand for retirement and how to save more.

How to Sign Up for Personal Capital In 2025

If you’ve read all of this and are thinking that Personal Capital has something to offer you, then you’re probably wondering how to sign up. It’s really easy… all you need is an email address, secure password, and phone number to set up your free Personal Capital account today.

Why do they need your phone number? It’s used to verify your account, but when you hit $100,000 in investments, a member of the Personal Capital team will give you a personal phone call to see if you’re interested in their wealth management features. There’s probably congrats in their too.

With any personal finance tool or budgeting app, the best way to start is to gather all of your information together before you get started. You can link most of your accounts through their platform, but making a list will ensure that you don’t miss anything.

You Have to Link Everything To Get a True and Accurate Picture of Your Finances.

You will want to connect your:

- Savings accounts

- Checking accounts

- Credit cards

- Student loans

- Brokerage/401(k) accounts

- Business checking accounts (very cool for self-employed people)

- Business credit cards

- Mortgage

- Any other loans

Using Personal Capital for Wealth Management

When you hit the $100,000 mark for investment assets, you are eligible to sign up for Personal Capital’s paid Wealth Management services. There are several levels of service available for a fee from 0.49%-0.89% of assets managed.

The levels of service include:

- Investment Service for up to $200k in investment assets. This includes access to a financial advisory team, tax efficient ETF portfolio, Smart Weighing™, 401(k) advice, cash flow and spending insights, 24/7 access including weekends and after hours, and support priority services.

- Wealth Management for up to $1M in investment assets. Including everything with the investment service and two dedicated financial advisors, customizable stocks and ETFs, full financial and retirement plan, college savings and 529 planning, tax loss harvesting, and financial decisions support.

- Private Client services for over $1M in investment assets. Including everything above and priority access to CFP®, advisors, investment committee, and support; investment portfolio mix of ETFs, individual stocks and individual bonds; family tiered billing; private banking services; estate, tax, and legacy portfolio construction; donor advisory funds; private equity and hedge fund review; deferred compensation strategy; estate attorney and CPA collaboration; and access to private equity investments.

Okay, that’s a lot of info to take in, but what all of that tells you is that Personal Capital has tools to help anyone, no matter where they’re at in their financial life.

Additional Personal Capital Features

24/7 customer service. Whether you need a phone or email support, Personal Capital is available for both free and paid users. They’ve even helped me answer questions for my readers, so I know they have stellar customer service.

Mobile app. There is currently an app available for both Apple and Android users. While it does have a seamless interface, you’re probably going to get the most out of their web version.

Security. To ensure the privacy and protection of your financial information, Personal Capital is read-only (no withdrawals or transfers can be made) and has two-factor authentication, military-grade encryption, continuous monitoring, firewall and perimeter security, and fingerprint scanning for Apple users.

Pros and Cons of Using Personal Capital

Overall, Personal Capital has a lot to offer users in 2025, but here’s a quick breakdown of why you will or won’t love it:

Pros

- Their free version alone has robust investment and retirement features for average users to get a handle on the long-term health of their finances.

- You get both budgeting and investing tools that might make Personal Capital the only personal finance tool you’ll need in 2025.

- 24/7 support comes with both the free and paid versions.

- The super clean design lets you focus on your finances.

- There aren’t any ads for third-party financial companies.

Cons

- If you’re looking for strictly budgeting tools, Personal Capital might overwhelm you with the financial planning extras, and you may get more out of apps like Mint or YNAB.

- The fees for wealth management services are on the higher end.

- There is a high minimum to access their wealth management advisors, which does include Robo-advisors.

The Final Word on Using Personal Capital In In2025

Let me sum this up by reminding you why I love and use Personal Capital on a regular basis – they offer exceptional, free tools for retirement planning. If you are behind on retirement savings or haven’t started, Personal Capital can help you develop a plan to reach that goal.

It also has robust enough tools for people working towards FIRE (Financial Independence Retire Early). If you fall into that category, you’ll love how Personal Capital can help you reduce your fees with the Retirement Fee Analyzer.

Setting up an account is free for anyone, and even if you do hit that $100k mark, you can still opt out of their paid services and while still getting a lot out of a free personal finance tool.

Start today, and sign up for Personal Capital!

All image sources via PersonalCapital.com

I’ve used a similar program called Mint. One thing I didn’t like about it was that it didn’t correctly auto-categorized many of my transactions. I didn’t like having to input all petty cash transactions manually, either.

Having said that, I’ll give this one a try and see how well it auto-categorize my transactions.

I haven’t used Mint in a while, but supposedly people are getting kinda fed up with the ads (PC doesn’t have any). I’m going to review that one in about a month so I’ll see for myself!

This one does a pretty good job, although it gets a little confused about some of my business transactions. For example, it has no idea what the heck I’m doing when I write myself a paycheck from the business! Other than that I’m happy with it.

How do you get all your data into the program? How much time does it typically take for you to do it?

Also, I am a millennial and know that the most valuable information about me is my financial data – given our situation. Do you know if they sell on data or info on users once uploaded? I like the idea but am not sure. Thanks for all the info!

Hey Sunny! It took about 10 minutes to get all of our accounts in. Some of them take a bit longer because of two-step authentication, but overall it was pretty quick and basically like signing in to your online bank accounts all in one place. You do have to re-enter your passwords from time to time I’ve noticed (especially if you don’t open your account for a while).

They do not share or sell your information. Check out their privacy policy at the bottom of the website – it is very clear about that!

I use PC on a semi-regular basis. I’m becoming less anal about checking my accounts on a daily basis — ain’t nobody got time for that! That said, you can’t be PC’s interface and ability to see your whole financial world in one window. To me, it’s a no brainer to use PC.

*Beat (sorry, newer keyboard over here!)

All good 🙂

Yeah it’s such a no-brainer if you’re comfortable with technology haha! I didn’t mention it in the review, but one of the coolest things it does is the email notifications of how much you’ve spent over the week compared to the previous one!

I felt the shade being thrown my way as the lone baby boomer lurking on your site, ha. Hey I love your blog and all thing personal finance. Once I drink in all you are serving, I jump over to the blogs of those posting to check out their musings and get inebriated with motivation to win. I’ve just begun my war on $40k of stupid debt and hope to be victorious in 2 years!! Keep up the good work. Sara

Hahahahaha Sara that just made my day! I like to give Boomers a hard time sometimes :)…mostly because there are so many things they can legitimately make fun of us for (man-buns and PokemonGo anyone?).

Believe it or not I have a decent amount of boomers hanging out here! A lot of them like to share the info with their kids, so it’s pretty cool. Good luck on tackling the $40k, you’ll get there!!!!!

Wow this app is a GEM!

Yep! It’s freaking awesome man.

As a boomer, I would NEVER give my account info. to anyone ( other than my wife) let alone on the net. It is not because I don’t trust people,,, I don’t trust anyone when it comes to money, hackers can get into anything.

Maybe someday I will, but not today. Just old school.

You already do the same thing by logging in to your brokerage accounts! 🙂 But, I get it. Not for everyone, millennials are just used to doing this type of stuff!

We use YNAB for budgeting, but thought I would give PC a try for quick Real Time updates. One thing I didn’t see is how to portray net worth accurately. We own a couple of rentals, one free and clear, and have a good amount of equity in our personal residence and property. I do not see where to include that in the net worth tracking. Without that net worth is not accurate. What am I missing?

Hey Cork – you’re right, without that you’re really just looking at liquid net worth! If you go to the + button for accounts on the left side of the dashboard, click “add home value” at the bottom left.

Now, they do partner with Zillow for market values, but you would just uncheck that box and fill in a manual home value. With that option you don’t need to put in the address.

Also on the + popup, there is a “more” button where you can add car values, jewelery, art, etc. Hope that helps!

Depending on how you are doing the cash flow for your rental, you can label those transactions individually to help organize them. If you want to be super accurate, you can just go in and manually update your home equity every month OR add an individual mortgage account.

Helps tremendously. I knew there had to be a way. Of course, going through the tutorial would have been the obvious way, but you know, I’m a man! 😉

Ha! Dude don’t worry I’m the same way. 🙂

I use YNAB also. I am curious about this financial tool, though.

Personal Capital is really awesome. I started using it earlier this year and it is a great way to track your portfolio allocations and re-balance when necessary. I check it once a month or so to see how things are going and then use Quicken on a weekly basis for tracking expenses and paying bills. The combination of both is the perfect setup for me!

Nice Jon! Yeah, it’s a great tool for a lot of reasons. No reason for people not to use it in my opinion.

At first, I wasn’t too interested in this website. But after opening my first brokerage account, I’m definitely going to check it out. I’ve learned it is a lot easier to organize with just a few things and then keep everything organized as you acquire new things, then to wait till you’re overloaded and it takes hours/days on end to straighten it out lol. Also, I checked my credit score and I am up 60 points from the last time I checked it two months ago!!! Hooray!! Progress!! Thanks for the great articles!

No problem Christa! Like I mentioned in the article, we love it. It’s just easier than having to open up a bunch of different accounts! I actually have my boat value in there too haha

I downloaded Personal Capital a few years ago, but still find myself using almost exclusively Mint. For whatever reason, a ton of my accounts simply cannot connect to Personal Capital and they won’t add them. Oddly, my Fidelity HSA – which I use as a secret retirement account – cannot connect to Personal Capital. When I asked them about it, they told me that HSA’s aren’t supported. That’s a pretty big problem if I’m using it to track my investments. Since Mint has worked fine for me, I’ve just been sticking with it.

To track my investment portfolio, I tend to use an app called SigFig, which connects everything and seems to work pretty well.

Thanks for the tip – I haven’t run into any issues like that yet, but I’ll update if I do!

I have an HSA through work with Health Equity and it pulled that data in just fine. I am having trouble linking a few other sites though. One of them is my primary bank account of all things.

I agree about the Mint though. I do like it better than PC for tracking transactions, but I got to admit the PC investment tracking and forecasting is miles ahead of Mint’s. It’s a nice tool for that in itself.

Thanks Jeffrey – I’ve been doing some more digging and from what I’ve found the HSA’s are supported. I’m going to call today and check on the Fidelity one. I have to resubmit my main bank account info from time to time because of the authentication on the bank’s website. All in all though, it’s free so I can’t complain too much haha

No idea why. My 401(k) was with fidelity and had no problem connecting. But my HSA, also with fidelity wouldn’t show up. I contacted Personal Capital (even tweeted them I think) and the response was that they don’t support HSAs. As of today, still can’t see my Fidelity HSA and they don’t support my work HSA through which my employer contributions get sent into.

Various other personal bank accounts I have aren’t supported either. So unfortunately, I just don’t get an accurate picture of what my account balances or net worth are from Personal Capital.

That’s a bummer, we’ve found it to be very helpful! I’m going to speak with them today and double check the HSA info. I know a decent amount of my readers have them.

*Update*

I contacted PC to see if they support HSA accounts (specifically Fidelity). Here was their response:

“Thanks for contacting Personal Capital Support. Yes, you should be able to link your Fidelity HSA account to Personal Capital. We do support HSA accounts in general, and specific account support depends on the institution.”

Another option for anyone that has issues is to manually add an account using the “more” option in the “+” dropdown on the left hand side of the dashboard. Hope that helps!

I used Mint for quite a long time and thought I’d give this app a try and I have to say I love it. When I linked my 401K and click on the fee analyzer I was amazed at what I was paying in fees for the funds I was invested in! Granted a savvy investor would have known to check the fees (I’m an amateur), it opened my eyes to what I would lose in fees over time. Thanks for posting on this, it’s my new favorite finance app!

Daniel that’s awesome! It’s crazy how many extra fees get packaged in to mutual funds isn’t it? Glad it helped!!!!! 🙂

Thank you SO MUCH for reviewing PC! 2017 is my year to crush student loan debt and take control of my finances, and I’ve never found a site as user-friendly and helpful as PC. I signed up this morning after reading your review, and I’m already in love! 🙂 Also, your blog is so inspiring. Reading through the site is fueling my motivation to tackle my financial goals. Thanks again!

🙂 No problem June! It really is a great resource considering that it’s free. I like the weekly spending updates and the retirement projections!

Glad you like the site!

Hi,

I’m a novice Quicken 2016 user. Don’t do much other than track transactions to see where my money goes each month. I’d like to monitor my HSA account with it but Quicken doesn’t have a way to create an HSA account. I’ve seen online where some people try it but it’s really not a valid HSA account.

Does PC allow you to set up an HSA account? Will I be able to monitor pre-tax contributions to it (monthly from my paycheck & company annual contrib’s) as well as payments from it for my health expenses?

Thank you.