What is the best high yield business savings account?

Whether you’re a full-time business owner or side hustling, you need a business savings account that works for you. You’ll notice that my list has more than just savings accounts, and that’s because a money market or high-interest rate checking account can occasionally offer higher annual percentage yields (APYs).

I specifically looked for banks with higher than average APYs — the current average is only 0.50% right now. And while rates are historically low, there are a number of banks that offer high yield accounts that also come with perks like zero to low fees, no minimum balance requirements, and more.

Best High Yield Business Savings Accounts for August 2025

| Account | APY | Minimum opening deposit | Monthly Fee |

|---|---|---|---|

Axos Business Premium Savings | 4.01% | $0 | $0 |

|

Live Oak Bank Business Savings |

0.50% |

$0 |

$0 |

|

First Internet Bank Money Market Savings |

0.40% |

$100 |

$5, waived with average daily balance of $4,000 |

|

Presidential Bank (Maryland) Premier Savings |

0.55% |

$5,000 |

$0 |

|

Small Business Bank |

0.20% to 1.0% |

$100 |

$0 |

Table of Contents

- 1. Axos Business Premium Savings | Up to 4.01% APY

- 2. Live Oak Bank | 0.50% APY, $0.01 Minimum to Earn APY

- 3. First Internet Bank | 0.40% APY, No Minimum to Earn APY

- 4. Presidential Bank (Maryland) | Up to 0.55% APY, No Minimum to Earn APY

- 5. Small Business Bank | 0.20% to 1.0% APY, No Minimum Balance Required

- What to Look For in a Business Savings Account

- What Is the Best Bank for a Small Business Account? The Final Word

1. Axos Business Premium Savings | Up to 4.01% APY

Axos Business Premium Savings has one of the highest interest rates, so it’s definitely worth considering.

Axos Business Premium Savings has an APY of up to 4.01% for all balances and it is not tiered. There’s no minimum opening deposit, daily balance requirements, and no monthly maintenance fee.

In addition, you have free domestic and international incoming wires. To ensure your funds are secure, all their business deposit accounts are FDIC insured up to $250,000. Axos offers new members a welcome bonus of up to $375 when you use promo code BPS375.

This business savings account is ideal for businesses that are looking to grow their savings while avoiding traditional fees and requirements.

Earn up to 4.01% APY

Axos requires no minimum deposit to open an account and has no minimum daily balance requirement.

2. Live Oak Bank | 0.50% APY, $0.01 Minimum to Earn APY

Live Oak Bank, based in North Carolina, has one of the best high yield business savings accounts with a variable rate APY of 0.50%. Compare that to the national average APY of 0.06%, and that’s an impressive rate even though interest rates are down overall.

Besides a higher-than-average APY, Live Oak does not charge any online banking or monthly maintenance fees. They do charge some miscellaneous fees (it’s unlikely you’ll encounter many of these, if any), including a $25 stop payment fee, $10 returned item fee, incoming wire $19, and outgoing wire $15.

There is no minimum balance to open your account, but you’ll need a $0.01 balance to start earning interest. Live Oak protects your savings with FDIC insurance up to $250,000.

The potential downside is that you only get up to six free withdrawals per month. They are $10 a transaction after that.

Earn up to 0.50% APY on your business savings

Live Oak has no minimum balance requirements, and they charge $0 monthly maintenance fees

3. First Internet Bank | 0.40% APY, No Minimum to Earn APY

Like the name suggests, First Internet Bank is an online bank, and like a lot of online banks, they can offer higher than average interest rates on their online business savings accounts. Right now, they have a variable APY of 0.40% on balances of $10,000,000 or below. Accounts with balances above that receive a 0.25% APY.

There are two high yield business savings options at First Internet Bank: Money Market Savings and Regular Savings. Both earn at the 0.40% APY right now, but their Regular Savings only requires a minimum average daily balance of $1,000 to avoid the monthly maintenance fee, while you’ll need to maintain a balance of $4,000 to avoid the fee with the Money Market Savings.

The monthly maintenance fees on both are minimal, but you should still be aware of them. The Money Market Savings has a $5 fee, and the Regular Savings has a $2 fee.

Both require $100 to open your account, and there is no minimum to earn the APY, which is a sweet perk of these accounts.

Sole proprietors will receive a First IB ATM card, and there’s no charge for ATM fees or electronic states. You can make up to six transfers or withdrawals a month, and there’s a $5 fee beyond that.

First Internet Bank accounts are FDIC-insured up to $250,000 — this is standard protection.

4. Presidential Bank (Maryland) | Up to 0.55% APY, No Minimum to Earn APY

Presidential Bank is offering a variable 0.50% APY with their Premier Savings account. This is for balances up to $35,000. Balances above that amount earn at 0.25% APY. You’ll need $5,000 to open your account and earn at those rates.

You can get ATM access with your Premier Savings account if you also sign up for a checking account through Presidential Bank. Their account also comes with free Personal Online Banking access.

Now, if you can maintain a much higher daily balance, you may want to consider Presidential Bank’s Commercial Money Market Advantage Checking account. If you can maintain a balance between $100,000 and $250,000, you can earn at a 0.55% APY. Balances under $100,000 earn at a rate of 0.25%.

The money market account comes with a Visa Business Debit Card, checking writing privileges, and a free check supply. The money market account does require a $100,000 opening balance, so it’s not for everyone but it has some serious perks.

Presidential Bank accounts are FDIC-insured up to $250,000.

Earn up to 0.55% APY for your business

Presidential Bank has savings options for all kinds of small business owners.

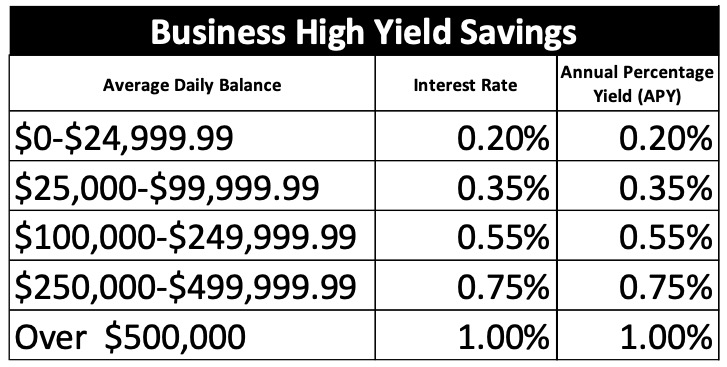

5. Small Business Bank | 0.20% to 1.0% APY, No Minimum Balance Required

Small Business Bank is the best business saving account for businesses that can maintain a high monthly balance. You earn an 1.0% variable APY with a balance of over $500,000.

They have tiered rates for account balances under $500,000:

Small Business Bank accounts are FDIC-insured, and there is no limit on monthly transactions, no minimum balance required, and no monthly maintenance fees.

You will need $100 to open a high yield business savings account with Small Business Bank. This is purely a savings account, as account holders don’t get debit card access.

Earn 0.20% to 1.0% APY

Small Business Bank charges $0 monthly maintenance fees, has no transaction limits, and there’s $0 minimum balance requirements.

What to Look For in a Business Savings Account

As you shop around and look for a place to stash your business savings, there are a few things I recommend you look for in a bank. These guidelines are exactly what I used as I looked through dozens of different business saving accounts to find the best options for you.

You’re Able to Earn Interest on Your Savings

There’s no reason that your business savings should sit in an account that isn’t paying interest. The current national average APY is 0.05%, so you should look for a savings account with that as a minimum.

No Monthly Maintenance Fees

Ideally, you find a bank that doesn’t have maintenance fees, but if your bank does have monthly fees, it shouldn’t take much to have them waived. Look for a bank without fees or monthly fees that you can realistically have waived each month. Monthly fees don’t usually cost much, but I want you to keep as much of your money as possible.

Also, look for a bank that has zero to low fees overall. Usually, you can find these options with online banks (they have a much lower overhead than brick-and-mortar banks and can pass along some of those savings to their customers). But to stay competitive, many brick-and-mortar banks have started waiving fees too.

No or Low Monthly Balance Requirements

The banks on my list all have no or low monthly balance requirements, and that’s important. There are too many savings account options right now that don’t require you to have a high balance — there’s no reason for you to be with a bank that penalizes you if your account balance dips too low.

Online Access

This is a no-brainer this day in age, but it’s still worth mentioning. Look for a bank with an intuitive online platform so you can do your banking in your own time, wherever you are.

What Is the Best Bank for a Small Business Account? The Final Word

What I look for when I compare business savings accounts is how am I going to save as much of my money as possible. I don’t want to pay fees, I want to earn interest, and I want the experience to be easy for me as a business owner. My time is money, just like you.

So the best high yield business saving account is going to tick all of those boxes, and I honestly think that all of the accounts on this list are solid choices. Axos Bank has the highest APY — currently 0.81% — out of anything on this list if you’re looking at high APYs alone.

But all of these banks have low to zero fees, and they come with perks for the modern business owner.

Shop around and see what fits your needs, but remember, there’s no reason that business banking should be expensive for you in 2025!