Real estate investing is one of the best ways to grow long-term wealth, and it’s no wonder that 90% of the world’s millionaires got started with real estate. Both Rooftock and Fundrise can help you build your real estate portfolio, but these are two very different platforms.

Roofstock is for purchasing single-family rental platforms, while Fundrise is for investing in eREITs and funds. Learn about their features, the minimum investment required for each, pros & cons, and more.

Table of Contents

- About Fundrise

- Ready to invest in real estate?

- Fundrise Minimum Investment

- How Fundrise Works

- Fundrise Features

- Fundrise Fees

- Pros and Cons of Investing With Fundrise

- About Roofstock

- Invest in cash-flow positive rentals

- Roofstock Minimum Investment

- How Roofstock Works

- Roofstock Features

- Roofstock Fees

- Pros and Cons of Investing With Rooftock

- Roofstock vs. Fundrise: Who They’re Best For

- Roofstock vs. Fundrise: The Final Word

Roofstock vs. Fundrise – Which is Best For You in 2025?

About Fundrise

Fundrise is a crowdfunded real estate platform that was founded in 2012, and they’ve since invested over $4 billion in real estate across the U.S. This platform is open to nonaccredited and accredited investors, and you can start investing with as little as $10.

What’s really important to know about Fundrise is that they are a crowdfunded real estate platform that specializes in non-traded eREITs and funds. If you’re unfamiliar with crowdfunded real estate, it’s when investors pool their money to fund and realize large-scale developments. The eREITs and funds at Fundrise hold diverse developments, including apartment buildings, single-family homes, and commercial developments.

Ready to invest in real estate?

Fundrise is a crowdfunded real estate investment platform that’s open to all investors.

Fundrise Minimum Investment

Fundrise recently lowered their minimum investment from $500 to $10 because they’ve seen more young investors looking for alternatives to the stock market.

How Fundrise Works

You’re investing in eREITs and funds with Fundrise. eREITs stand for real estate investment trusts, and their funds are pooled money used to purchase and develop land that’s sold to home buyers. Fundrise recommends specific eREITs and funds based on your portfolio and investment goals.

You earn money on your investments in a couple of different ways:

- Dividends: Fundrise dividends are your share of any income generated from the projects in your portfolio. These are quarterly cash payments that are distributed to your bank account or reinvested. Fundrise dividends fluctuate and are not guaranteed.

- Appreciation: Money earned when the value of your shares increases over time, through both equity and debt investments. Typically a more substantial portion of your returns, but it takes longer — Fundrise asks you to leave your investment for at least 5 years.

Fundrise Features

Low minimum investments

The fact that you can invest in real estate for as little as $10 will be a major selling point for some people, and it’s a key difference between Fudnrise and Roofstock. Fundrise is also open to more than just accredited investors, which means you have a net worth of more than $1 million (not including your home) and an annual income for at least $200,000 for individuals or $300,000 for couples.

Redemptions

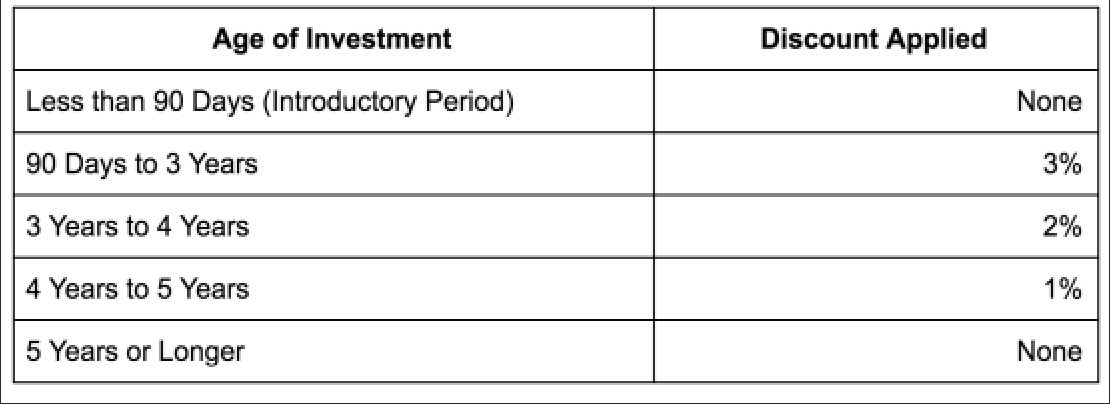

Fundrise investments are seen as highly illiquid, they’d ideally like you to commit to at least 5 years. However, they have a redemption program that allows you to redeem shares early.

The 90-day introductory period for new accounts allows you to try out Fundrise and request redemption on your investments without paying any advisory fees or redemption penalties.

It’s worth noting that Fundrise reserves the right to suspend redemption, which they did in March 2020 because of the economic fallout caused by the pandemic. This was a temporary suspension, but you should be aware that it can happen again in the future.

Auto-invest and DRIP

While it’s not required for your account, you can set up recurring investments to automatically invest funds in your portfolio. Another option available to investors is DRIP (dividend reinvestment program), which automatically invests your dividends back into your portfolio.

Fundrise Fees

There is an annual 1% fee to invest with Fundrise, which is broken down into an annual advisory fee of 0.15% and an annual asset management fee of 0.85%.

However, you are likely to incur some additional fees that are buried in their circulars. These include:

- For IRA investing: Fundrise’s IRA custodian, Millennium Trust Company, charges an annual fee of $125.

- Organizational and offering costs: This is the cost of bringing the eREIT or eFund into existence, and Fundrise says these run 0% to 2% of the money raised by investors. These are reimbursed to the manager out of the eREIT or eFund in monthly installments that do not exceed 0.5% of the fund’s total proceeds.

- Potential development fees on eFunds: Up to 5% of total development costs, excluding land. There may also be a potential disposition fee when an eFund sells a property, which is 1.5% of the gross proceeds, after repayment of property-level debt.

Pros and Cons of Investing With Fundrise

Pros

Low initial investment: A $10 minimum investment breaks down one of the barriers to investing in real estate.

Open to nonaccredited investors: You don’t need to be an accredited investor with Fundrise.

Passive way to invest in real estate: Real estate investing can take work (think rehabbing houses or managing rentals) but Fundrise is truly passive investing.

Transparent process: Fundrise lets you know exactly what you’re investing in.

Cons

Highly illiquid: You need to be willing to sit on your investments for 5 years to realize any real returns.

Complicated fees: On the surface, Fundrise’s fees are 1% — 0.15% annual advisory fee plus 0.85% annual asset management fees — and those are fairly low. But the reality is that there are more fees that aren’t easy to see.

Fundrise may delay or suspend redemptions: Fundrise had its model tested for the first time in March 2020 as the economy began facing extreme uncertainty. As a result, it suspended and delayed redemptions from March until July. But we’re yet to see what would happen if there was a major housing market crash.

About Roofstock

Roofstock launched in 2015 is a platform where investors can buy and sell turnkey properties or entire real estate portfolios holding multiple properties. These are single-family rental (SFR) homes that generate monthly income for investors. In addition, the homes you’re buying are already rented out, so you gain immediate cash flow. Roofstock also offers affiliate property managers to professionally manage the properties for you.

Ultimately, Roofstock’s goal is to make buying rental property a passive process all around, from buying and managing your rentals. They also help to facilitate 1031 exchanges, offer a 30-day money-back policy, and give you a Lease Up Guarantee on unoccupied homes.

Invest in cash-flow positive rentals

Roofstock helps you find and purchase occupied rentals from across the U.S. so you can immediately generate monthly rental income.

Roofstock Minimum Investment

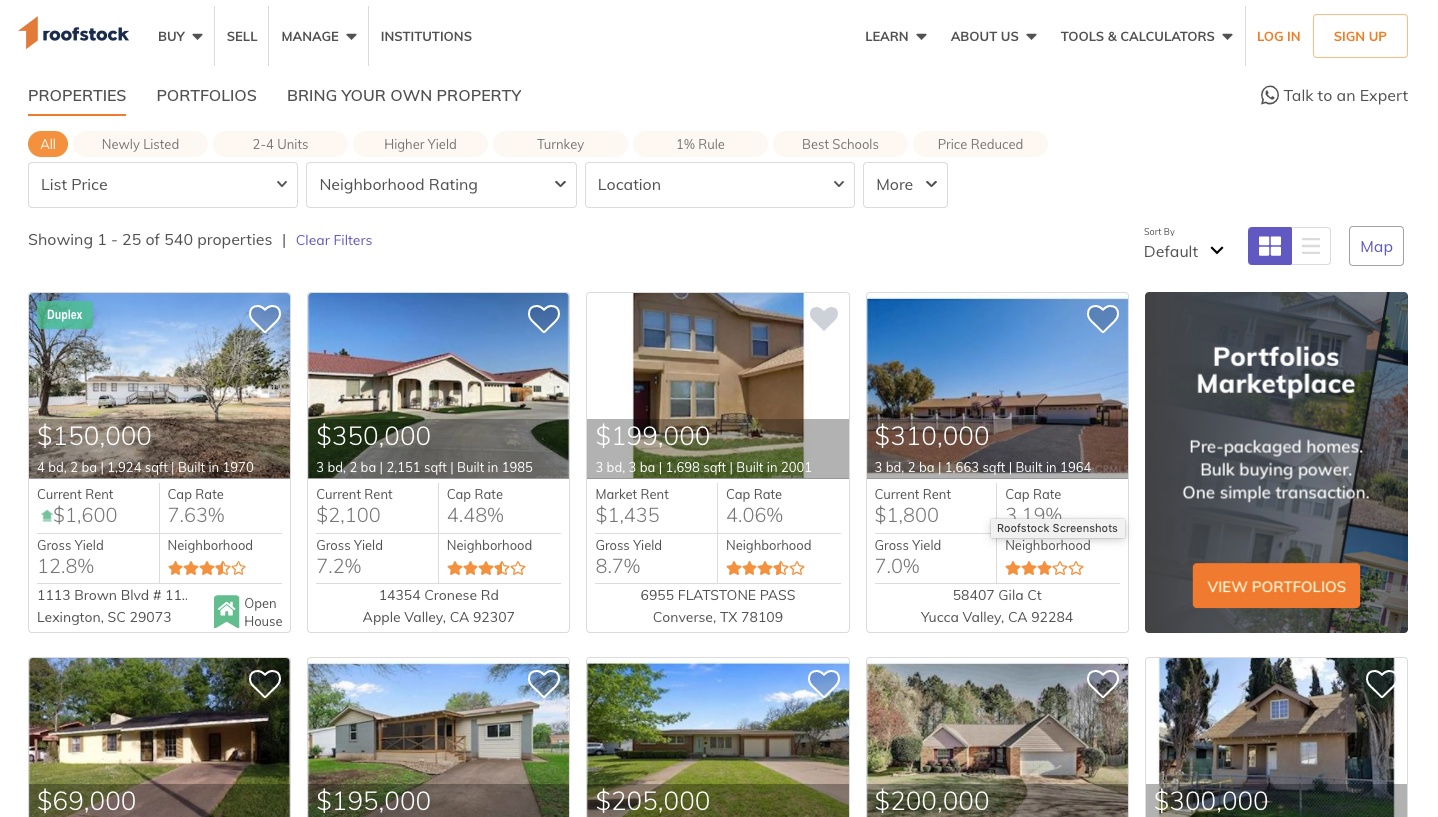

There’s no set minimum investment to invest in real estate through Roofstock — your minimum is the property’s purchase price. As you can imagine, there is a wide range of prices, from $25,000 to $1 million+.

If you take out a loan to buy the property, most lenders will require you to put at least 20% of the purchase price down. You will also be required to pay closing costs, which are generally 4% to 5% of the purchase price. For a $100,000 investment property, you would be looking at about a $20,000 down payment and $4,000 to $5,000 in closing costs.

Learn more in our full Roofstock review.

How Roofstock Works

Roofstock is not a crowdfunded platform, instead, they source properties for potential investors. Most of the properties are being sold by independent sellers, with Roofstock acting as the sellers’ agent on the listing and transaction.

Before Roofstock takes on any properties and lists them on the platform, they go through a lengthy vetting process to certify properties that includes:

- Walkthrough inspection done by an experienced, third-party inspection vendor (some properties have an inspection contingency that says the property will be inspected after an offer has been inspected)

- Review the inspection to ensure that necessary repairs won’t cost over 15% of the listing price and the property meets certain standards for the HVAC system, won’t require immediate roof repairs, no electrical or health and safety issues, etc.

- Identify necessary repairs and providing cost estimates to buyers before they put in an offer or prior to closing

- Have the seller confirm a good rent payment history

- Provide all of the information and data that Roofstock collects about a property on its listing page

Each property listing includes photos, purchase price, rent, and the expected total return in different time frames. Roofstock also lists important investment analytics like annualized return, cap rate, gross yield, cash flow, and rate of appreciation.

Once you’ve purchased an investment property through Roofstock, you are the property owner and hold the title. You’re responsible for maintenance, property management, leasing, taxes, etc. Roofstock will recommend vetted property managers if you want to be completely hands-off.

Roofstock Features

30-Day Money Back

Roofstock’s money-back policy says that if you’re unsatisfied with your purchase for any reason, they will re-list the property for free on their marketplace. Once the property sells, Roofstock will refund the original purchase price at closing regardless of the price it re-sells for.

You’re still required to maintain and manage the property until it’s sold, and it needs to be in the same condition as it was sold to you.

Lease Up Guarantee

Roofstock knows that occupied rentals are much more appealing to investors because they can start generating cash flow from day 1. This is why they offer the Lease Up Guarantee, and it states that you will secure a signed lease within 45 days, or they will cover rent for up to a year.

You must work with one of their preferred property managers to fill your vacancy to be eligible, have the property in rent-ready condition, and that you must accept qualified applicants that pass screening guidelines. The Lease Up Guarantee isn’t available for duplexes, multiplexes, or homes purchased as part of a portfolio.

Invest through IRA or solo 401(k)

Roofstock allows you to purchase rental properties using funds held in your self-directed IRA or solo 401(k).

Roofstock Fees

There’s no cost to create an account and browse Roofstock’s marketplace. When you purchase a property, you’ll be charged a marketplace fee equal to 0.5% of the contract price on the house or $500, whichever is higher. You pay that fee once your offer is accepted on a home.

Pros and Cons of Investing With Rooftock

Pros

Cash-flow positive investments: Roofstocks lists properties that are already occupied with tenants so you can start generating income immediately.

Direct ownership: Buying a rental property is a tangible asset that allows you to take advantage of rental income or sell later if that makes more sense.

Low fees: Roofstock relies heavily on technology, which like robo-advisors, allows them to charge lower commissions to sellers, which keeps costs down.

Cons

Requires large initial investment: You will likely need to put down at least a 20% down payment on the property you purchase through Roofstock because it’s not your primary residence.

Highly illiquid investment: Real estate is known as a notoriously illiquid investment, meaning if you need cash quickly, you may find yourself in a tight spot.

Rental properties require a lot of work: You can have a more passive experience if you hire a property manager, but things break, the home will need maintenance, you might have renters that don’t pay, etc.

Buying a rental online is risky: You’re relying on a platform to do the heavy lifting for you, but this is still a relatively new platform. Roofstock works hard to mitigate the risks, but buying a property sight unseen and relying on inspections can be risky.

Roofstock vs. Fundrise: Who They’re Best For

Roofstock is best for people who want to own rental properties. Rental properties aren’t as passive as crowdfunded real estate, but they can be passive if you use a property manager.

Roofstock investments require a high minimum — at least a downpayment on a house — so you’ll need to be able to have plenty of cash on hand and be able to secure a loan.

Fundrise is best for those who want passive real estate investment experience because you’re investing in a portfolio of properties that is managed by Fundrise.

Because Fundrise’s minimum is only $10, it’s a better option if you want to start investing slowly.

Roofstock vs. Fundrise: The Final Word

Roofstock and Fundrise are very different real estate investing platforms. Fundrise has a minimum $10 investment, and the process is incredibly passive because you’re investing in eREITs and funds. Roofstock is used for purchasing single-family rentals that their team has vetted. The home are already occupied, so cash-flow positive, but you’ll need to commit to at least a downpayment.

Both are highly illiquid investments because that’s the nature of real estate. So make sure you’re aware of that before proceeding.

Disclosure: We earn a commission for this endorsement of Fundrise.