Fundrise is a real estate investing platform that was founded in 2010 and lets unaccredited investors start investing in commercial and large-scale residential real estate. Starting at $10 you can begin to invest in commercial real estate with Fundrise, making real estate investing more accessible than ever before. Overall, Fundrise makes it easy to start investing in real estate, but it’s highly illiquid and investors need to be aware of Fundrise fees to make a smart decision.

RECOMMENDED FOR:

- Passive investors

- Real estate investors

- Long-term investment

PROS:

- Low minimum investment

- Open to all investors

- Access to diverse portfolios

- Passive investment

- Transparent platform

CONS:

- Highly illiquid

- Complicated fees

- Potential delays or suspended redemptions

If you’ve been interested in real estate investing but don’t think you have the fund to start, Fundrise has an appealing offer: invest in commercial real estate starting at $10 with the Fundrise Starter Portfolio.

Fundrise’s crowdfunding approach lets everyday investors access real estate markets that were previously inaccessible. In this review, we will take a closer look at how to invest with Fundrise.

Fundrise Overview

You can start investing in Fundrise for as little as $10 — this is for the Fundrise Starter Portfolio. But Fundrise offers five different account levels, and with all of them, you’re investing in non-traded eREITs and eFunds.

REITs are similar to an ETF because REITs hold many different investments in properties. Fundrise’s REITs aren’t publicly traded, so they’re called eREITs. Fundrise’s eFunds are pools of money used to develop new homes targeted at first-time, move-up, and active adult homebuyers.

For higher account levels — minimum investments range from $1,000 to $100,000 — you can invest in a diverse portfolio of eREITs, the Fundrise IPO, customize your portfolio, access Fundrise’s Self Directed IRA program, and more.

4 Ways to Invest with Fundrise Real Estate

1. Fundrise Starter Portoflio

For only $10, you can invest in the Fundrise Starter Portfolio, and it’s a popular choice if you want to test out the platform or if you’ve never had experience investing in private real estate. Originally the minimum investment was $500, but Fundrise relaunched it in 2021 to lower the minimum investment.

$10 will gain you access to a diverse mix of U.S. real estate projects divided 50/50 between Fundrise’s income eREIT and the growth eREIT. Investors see returns through quarterly dividends and appreciation of the share value.

There’s a total 1% fee to invest in the Fundrise Starter Portfolio, which includes the following two fees:

- 0.85% fund management fee to Fundrise

- 0.15% account management fee

2. Fundrise Self Directed IRA

Fundrise has partnered with Millennium Trust Company to provide IRAs, and you can transfer an existing IRA and invest in any of Fundrise’s eREITs. There’s a $75 fee to get started with a single eREIT, but there is a $125 fee if you decide to invest in multiple funds.

You’ll need to be enrolled in at least the Basic plan starting with a $1,000 minimum investment. Fundrise’s IRAs are only available for eREITs, not eFunds. This might not make sense for every investor, so be sure to check out your options. If you’re self-employed, check out Best Self-Employed Retirement Funds to learn more.

3. Fundrise iPO

The Fundrise iPO is an internet public offering (unlike a traditional IPO, which is an initial public offering when a company first goes public). With the Fundrise iPO, you’re buying an ownership stake in the Fundrise, owned by Rise Companies Corp, which is the name of the company you’re buying stakes in.

4. Fundrise Flagship Fund

If you want something more liquid, Fundrise’s Flagship Fund is an option that’s larger than Fundrise’s other funds and offers improved access to your invested money through quarterly repurchase offers. There are no penalties to liquidate through the Flagship Fund, and you can invest in this fund with the Fundrise Starter Portfolio and up.

Fundrise Returns

While there are no performance guarantees, Fundrise has historically performed well. It hasn’t had a down year yet, and even in 2020, Fundrise portfolios were resilient to economic challenges. Below are Fundrises’s historic annualized returns:

- 2021 22.99%

- 2020 7.31%

- 2019 9.16%

- 2018 8.81%

- 2017 10.63%

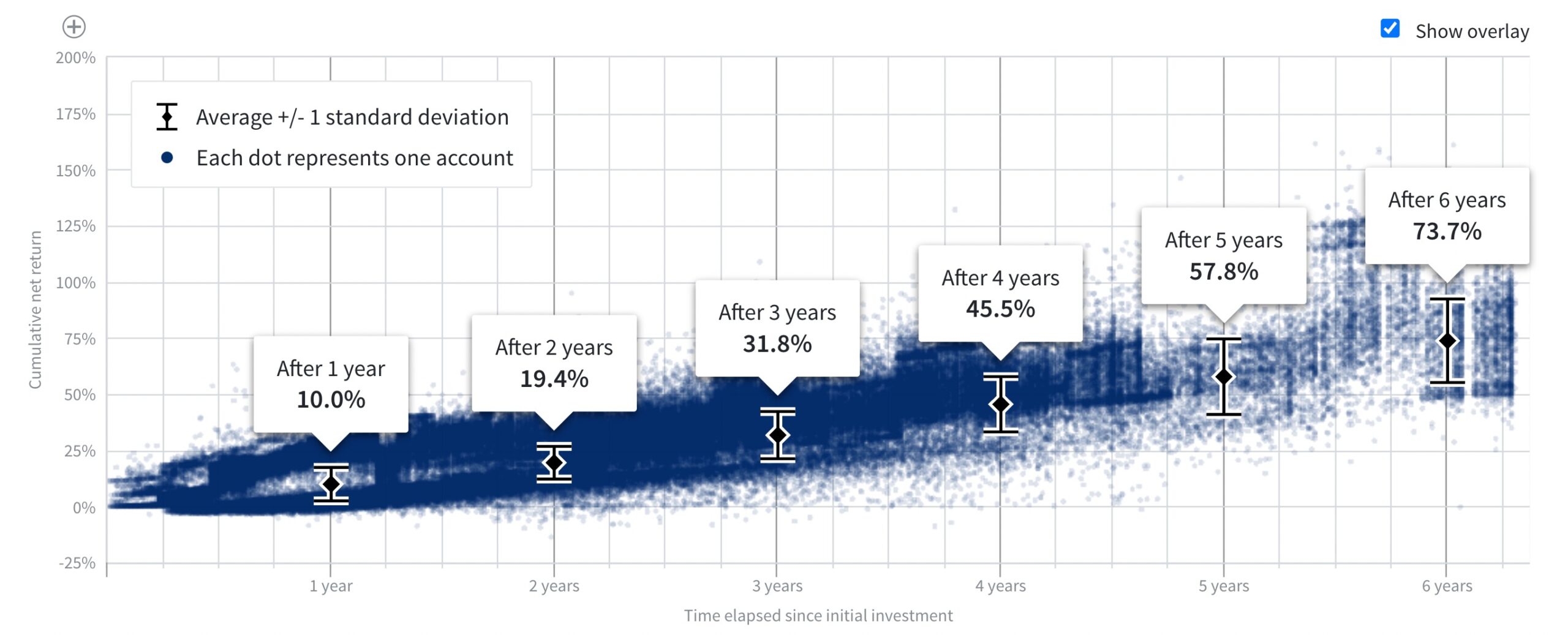

Additionally, here’s a snapshot of real-time returns on client accounts:

Fundrise real estate investments should be considered a long-term investment, whether you’re invested in the Fundrise Starter Portfolio or through a Premium account, and that chart makes that pretty clear.

A Note About Fundrise’s 2020 Returns

In 2020, Fundrise decided to safeguard its cash reserves to avoid having to sell any assets. As a result, they ended the year with $265 million cash on hand (approximately 20% of their collective equity). In their 2020 year-end letter to investors, Fundrise acknowledged that holding so much cash lowers returns in the short run and disproportionately impacts newer investors.

Fundrise published their 2020 net returns by the age of account to emphasize their point and affirm the importance of having a long-term outlook. You can see that Fundrise investors still saw positive returns despite the effects of the pandemic:

Fundrise Redemptions

Investors are encouraged to hold onto their shares for at least 5 years, but Fundrise’s Redemption Program allows investors to sell shares back with a 1% fee.

Fundrise also reserves the right to suspend or delay redemptions, which it did in 2020 because of economic uncertainty. This isn’t uncommon in real estate investing, so you need to keep that in mind before you get started.

Fundrise Fees

Fundrise says it can reduce some of the costs of real estate investing because they’ve eliminated most intermediaries by bringing the process in-house. Getting rid of those middlemen lowers overhead costs, and Fundrise says they pass those savings on to their investors.

However, there are still some Fundrise fees, which are common with crowdfunded real estate investing, and some of them are difficult to see unless you’re willing to read through Fundrises’s circulars. Circulars are abbreviated prospectuses that explain a new securities offering — they are legal documents and are required in many cases.

Here’s a breakdown of Fundrise’s fees:

- Annual advisory fee: 0.15%.

- Annual asset management fee: 0.85%.

- For IRA investing: Fundrise’s IRA custodian, Millennium Trust Company, charges an annual fee of $75 or $125.

- Organizational and offering costs: This is the cost of bringing the eREIT or eFund into existence, and Fundrise says these run 0% to 2% of the money raised by investors. These are reimbursed to the manager out of the eREIT or eFund in monthly installments that do not exceed 0.5% of the fund’s total proceeds.

- Potential development fees on eFunds: Up to 5% of total development costs, excluding land. There may also be a potential disposition fee when an eFund sells a property, which is 1.5% of the gross proceeds, after repayment of property-level debt.

How Does Fundrise Compare?

Fundrise isn’t the only real estate investment platform online, so here’s how it compares to two popular competitors:

Fundrise Review: Pros and Cons

Pros

- Low initial investment: A $10 minimum investment lets you invest in the Fundrise Starter Portfolio and breaks down one of the barriers to investing in real estate.

- Open to all investors: You don’t need to be accredited to invest in real estate through Fundrise, unless you want to invest through the Premium plan.

- Access to a diverse portfolio: Fundrise keeps your goals in mind as they help you pick the right portfolio. You can go for quick gains or bigger, long-term ones.

- Passive way to invest in real estate: Real estate investing can take work (think flipping houses or managing rentals) but Fundrise is truly passive investing.

- Transparent process: Fundrise lets you know exactly what you’re investing in.

Cons

- Highly illiquid: You need to be willing to sit on your investments for 5 years to realize any real returns.

- Complicated fees: On the surface, Fundrise’s fees are 1% — 0.15% annual advisory fee plus 0.85% annual asset management fees — and those are fairly low. But the reality is that there are more fees that aren’t easy to see.

- Fundrise may delay or suspend redemptions: Fundrise had its model tested for the first time in March 2020 as the economy began facing extreme uncertainty. It suspended and delayed redemptions from March until July. But we’re yet to see what would happen if there was a major housing market crash.

Fundrise Review: The Final Word

Fundrise makes commercial real estate affordable and accessible to average investors, and you can invest in the Fundrise Starter Portfolio for as little as $10.

You’ll need a much larger investment than that to see any real returns that help you reach your long-term financial goals, but $10 is your way in. Keep in mind that Fundrise is a fairly illiquid investment, so make sure you’re diversifying your larger investment portfolio.

Interested in alternatives to Fundrise, check out Real Estate Investing for Beginners.

FAQs

No, because of the JOBS Act of 2012, Fundrise and other crowdfunded real estate platforms offered options to non-accredited investors.

Before 2012, an investor needed to meet these requirements: have an annual income exceeding $200,000 ($300,000 for joint income) for the last two years, or have a net worth exceeding $1 million, not including their home.

Fundrise has a multi-step application and underwriting process that all investments must go through to be considered and approved that includes:

– Screening potential investments to make sure they are top-performing companies with a record of success. Fundrise claims that only a quarter of the companies that apply make it past this step.

– Companies must understand their project due diligence, which requires investors are paid back before the company realizes profits.

– Fundrise has a 350 data point analysis protocol during their underwriting process to ensure the projects they offer investors will be quality investments.

– Fundrise actually pre-funds the investment before their investors do. This means they are taking on the risk before you do.

There is a $10 minimum investment to start with Fundrise, but how much you invest depends on your financial situation. Because your money will be tied up for a while, you want to consider having other more liquid investments before starting with Fundrise.

You must submit a redemption request to redeem your shares. Redemption requests are available under your account settings once you’re logged into the site.

Remember, Fundrise is a long-term investment, and you will be penalized for redeeming your shares before 5 years.

Disclosure: We earn a commission for this endorsement of Fundrise.

I appreciate your thoughts on the pros and cons associated with the investment in commercial property through a fundraising organization. A lot of investors wants to buy a residential, commercial or rental property to fulfill their real estate dream. But, the lack of an adequate amount of funding makes it impossible. So, one should simply invest in an alternative form of real estate investment. One could invest in the real estate passively by investing in different types of crowdfunding platforms. Besides, one could also invest in a real estate investment company.