The Everlance app’s features are designed for self-employed and gig workers who need to track their miles and expenses for tax time. There are automatic tracking tools, generated tax reports, a deduction finder, and more. Everlance has three plans, from $0-$15/month, and the paid plans come with a 7-day free trial. Overall, Everlance is a solid tool that’s great for food delivery and rideshare drivers.

RECOMMENDED FOR:

- Self-employed people

- Food delivery drivers

- Rideshare drivers

PROS:

- Free expense and mileage tracker

- Ease of use

- Intuitive design

- Free trial

CONS:

- Limited free app

- Drains battery life

Table of Contents

Side hustling as a freelancer, food delivery driver, or rideshare driver is a great way to boost your income. But keeping track of your expenses and miles can be a huge pain. That’s where the Everlance app comes in.

Since Everlance was founded in 2015, it’s grown to over one million users who have logged more than 500 million miles using the app. This app’s goal is to make tax time easier, and today I’m going to explain Everlance’s full list of features, how much it costs, and more.

What Is The Everlance App?

The Everlance app is a mileage and expense tracker for freelancers available on iPhone and Android devices. At the base level, the Everlance mileage app automatically tracks your trips, makes it easy to upload receipts, and creates IRS-compliant reports.

Not all independent contractors need a bookkeeper or accountant, but they all need to know their profits and losses so they can be reported on a Schedule C tax form. Everlance helps by tracking three key things:

- Mileage: Anyone who makes money driving their car – rideshare drivers, food delivery service drivers, Amazon flex drivers, etc. – should be tracking their mileage so they can make the appropriate deduction on their taxes.

- Expenses: Think of all the things you spend money on for your business. This could be your cell phone, data plan, apps you use to track mileage (seriously, you can deduct the cost of Everlance at tax time), and more.

- Revenue: You need to track every dollar if you make money driving.

Everlance stores that information in your account, and when tax time comes around, you can run reports to make it easier to fill out your tax forms.

Everlance features

Here’s a break down of the features that Everlance offers to help you track your mileage, expenses, and revenue:

Automatic Mileage Tracker

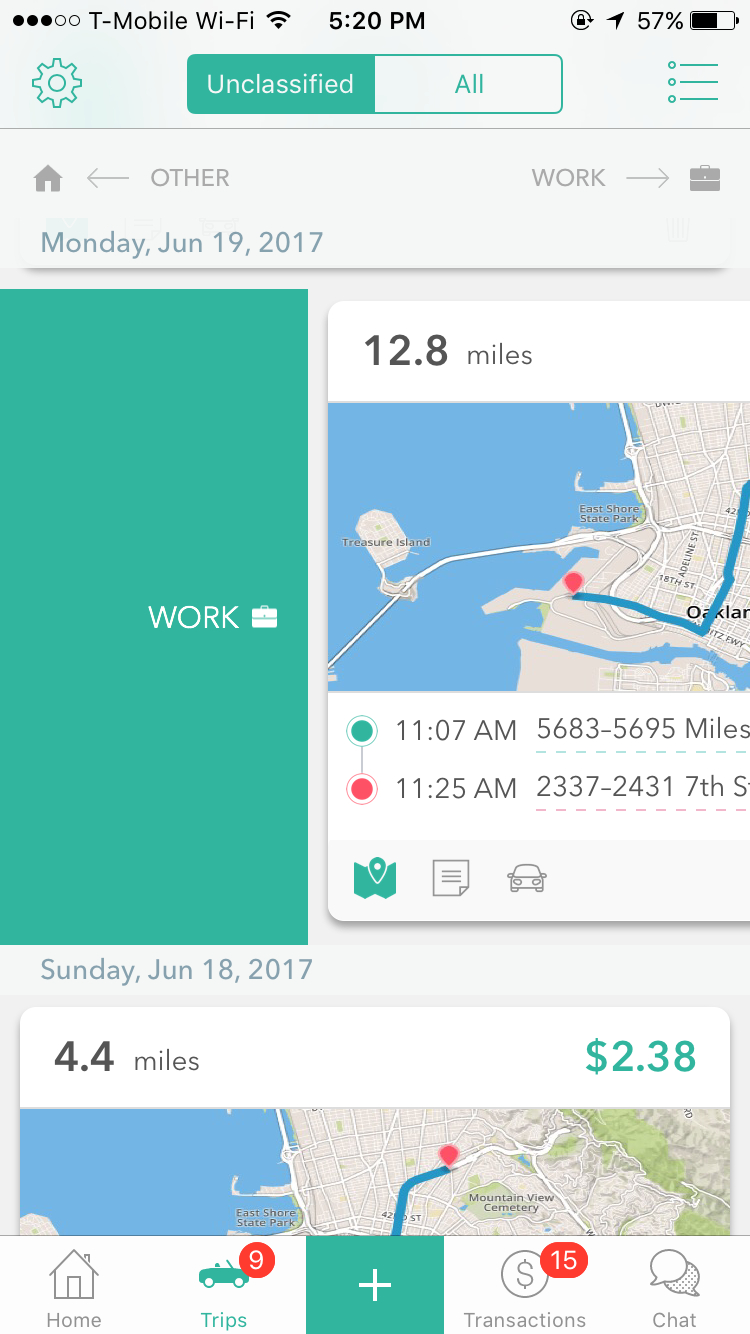

When you get in your car to drive, the Everlance app automatically starts detecting where you’re using GPS and starts tracking your trips. You do have to go back and classify your trips, but this just means swiping left or right on the screen.

You swipe right for work and left for personal use. Everlance stores that trip in terms of miles in the app. This creates a mileage receipt for your trips that you can use to take mileage deductions.

There’s also a manual tracking option, and Everlance says this is more accurate – you won’t accidentally misclassify anything. To use the manual option, you open the app and click the “Start Tracking” button.

You can also set work hours if you’re using Everlance Premium. What’s nice about this option is that it only tracks trips during certain hours, which reduces the need to go through and classify every single trip you make – you only have to worry about the trips you made during hours when you were most likely driving for work.

Expense and Receipt Management

There are a couple of different ways to track your expenses. The free version of Everlance lets you take pictures of your receipts and store them in the cloud. This can be gas, maintenance costs, phone bills, etc.

If you want to streamline the process, Everlance Premium lets you connect your bank and credit card accounts to the app and syncs your transactions. Being able to connect credit card accounts is a new feature.

You can scroll through a list of big banks or search for yours in the app. You’ll be brought to a secure log-in page through your financial institution, and then select the accounts you want to sync. You have the option to sync:

- Last 12 months and all future transactions

- Last 30 days and all future transactions

- Only future transactions

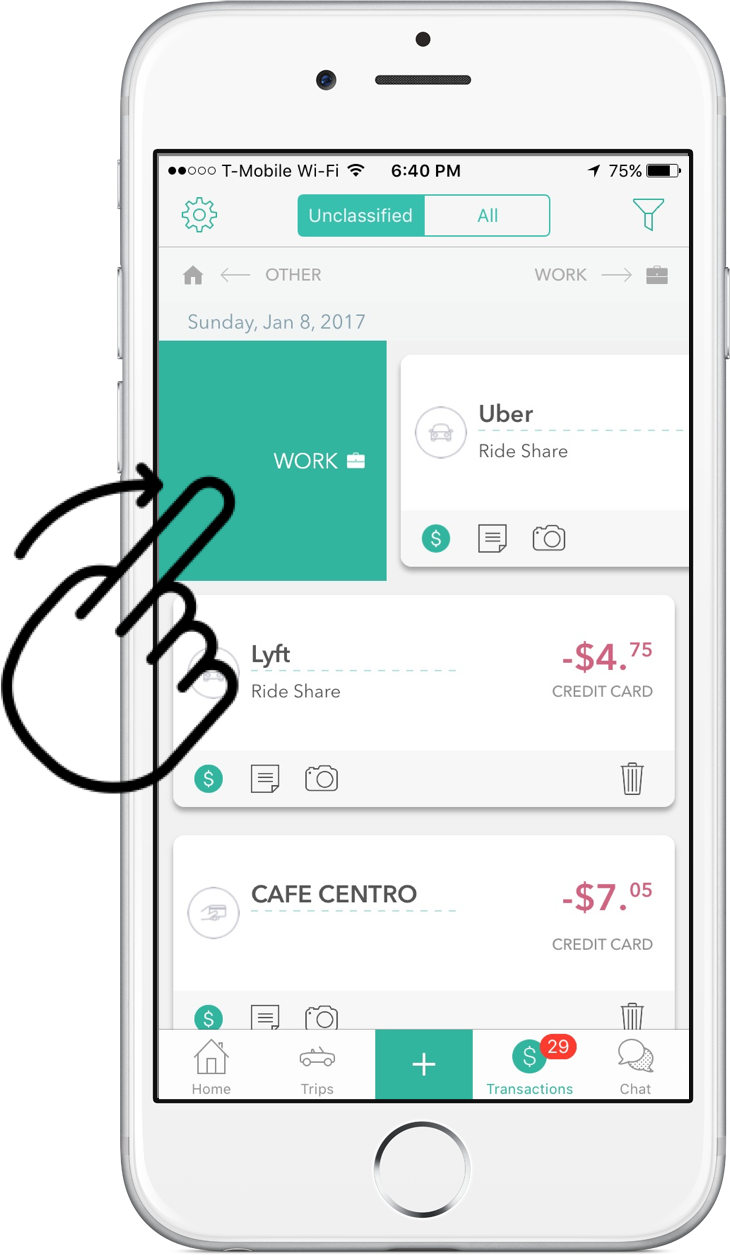

It takes up to an hour for Everlance to generate your transactions, and then you’ll see all of your transactions categorized in the app. From there you can start classifying transactions as work-related or personal.

You use the same right or left swipe to classify expenses.

Tracking Your Income

If you’ve synced your bank up with the Everlance app, it will see payment coming in from whatever rideshare or food delivery services you work for. But you can add these manually, too. You enter the amount you earned, the date, and add any notes you’d like to keep.

Deduction Finder

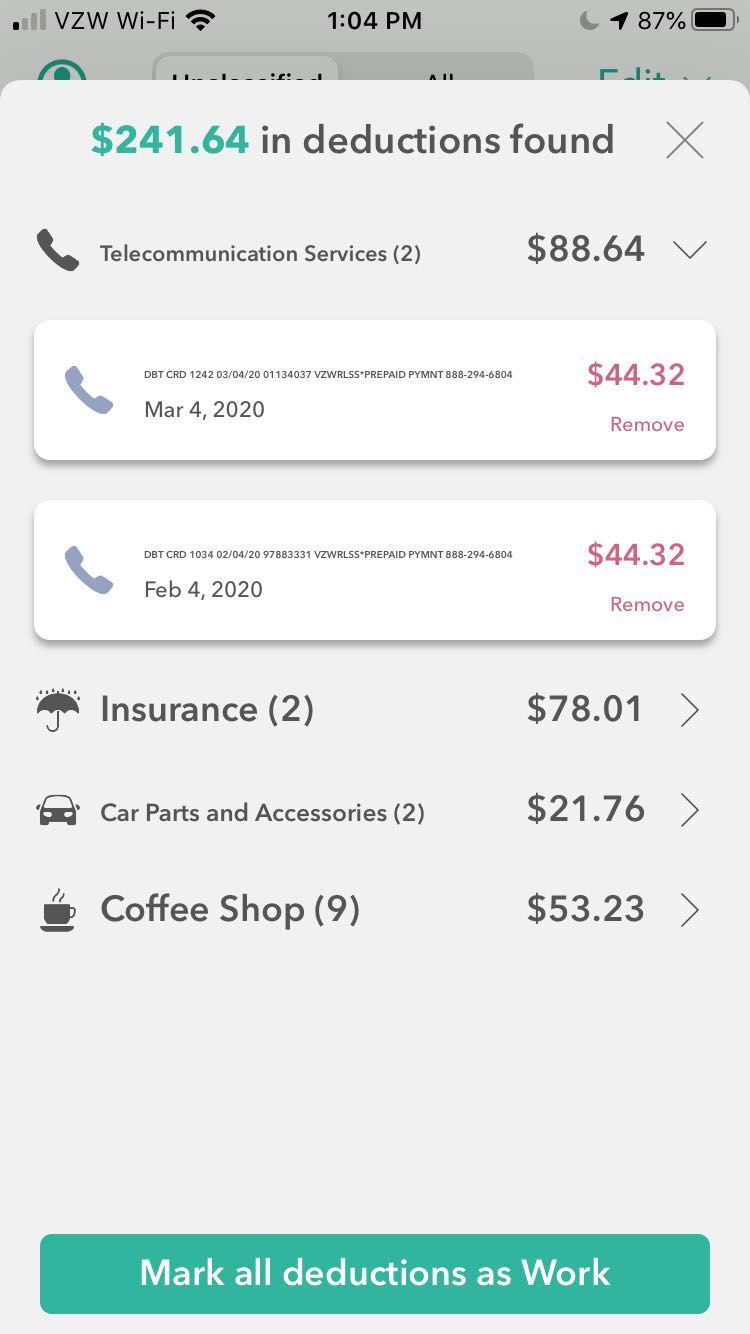

The Everlance mileage app also helps you find deductions to take at tax time if you forget to classify any of your expenses. You connect your credit card to the app, tell Everlance what you do for a living, and then Everlance scans your transactions to come up with a list of potential tax deductions.

You’ll need to review the list of potential deductions and make sure everything is organized correctly. Then the app creates an IRS-ready report that you can use at tax time. It lists deductions for both Schedule C and 1099-MISC forms.

Everlance App Integrations

Everlance has native integrations with two popular accounting platforms: Xero and Freshbooks. You can export data stored in the Everlance app to either platform if you use it.

Tax Reports

The Everlance app makes it easy to export your data for tax reporting purposes whenever you want. You can have it emailed directly to your accountant or download it if you’re filing taxes on your own. Basic tax reports are accessible for free and Premium users.

Premium users can export tax reports in Microsoft Excel, CVS, or PDF formats. You can request mileage or expense/deduction reports, and there are advanced filtering options for Excel.

Read more at .How to Handle Taxes for Your Side Hustle

Everlance Dashboard Partners

If you’re already driving for a rideshare or food delivery service, Everlance has already partnered with several of them so you can get a free 3-month trial of Everlance Premium. Here are the apps Everlance is partnered with:

- DoorDash

- Caviar

- TaskRabbit

- Favor

- Shipt

- Wonolo

There are company-specific sign-up pages you use to access the free trial. You will be asked to enter your credit card information, but you won’t be charged until after the promo period is over.

Customer Service and Support

Premium Everlance users get VIP customer support where you can chat with representatives directly in the app. Free and Premium users can use email to contact support if they have any issues.

Everlance App Pricing

Everlance has a three-tier price structure for self-employed people, ranging from $0-$10/month.

The most popular tier is the $5/month Premium plan, and it comes with a free 7-day trial. The Premium level comes with:

- Unlimited automatic trip detection

- Automatic expense tracking with bank and credit card sync

- Trip auto-classification with work hours and commute

- Custom Excel and PDF exports

- Deduction finder

You can also upgrade to Premium Plus for $10/month — it comes with a free 7-day trial. This adds the following features:

- Customized 1×1 training

- VIP customer support

The basic level is a 100% free mileage tracker app, but it has limits. Here’s what you get with the free version of Everlance that comes with:

- 30 automatic trips per month (you have to manually track your trips after 30)

- Unlimited manual start and stop trip tracking

- Expense tracking with unlimited receipt uploads

- IRS-compliant Excel and PDF data reports

You can set up monthly or annual billing with all of Everlance’s paid plans, and they all have a free 7-day trial.

Everlance Pros and Cons

Pros

- Free expense and mileage tracker: While it has limitations, the free version of Everlance will automatically track 30 free trips and you can manually log your expenses.

- Ease of use: The Everlance app has a user-friendly interface and really does make it easy to keep track of your miles and expenses.

- Intuitive app: Everlance quietly runs in the background, gets to know your driving habits, and begins to classify trips for you. For example, if you drive to church every Sunday, Everlance quietly runs in the background and will note that and not classify it as work.

- Free trial: You get a 7-day free trial when you sign up for either paid plan, which allows you to test out Everlance before committing to a paid option.

Cons

- The free app has limits: Once you’ve hit 30 trips with the free version of Everlance, you will have to manually enter everything after that. This isn’t the biggest bummer, but it’s worth mentioning if you’re interested in the free option.

- Drains battery life: Because Everlance runs in the background, it will drain your battery. Veteran drivers recommend keeping a charging cable in your car and turning the app off when you’re not driving for work.

Everlance Is Best For:

Food Delivery and Rideshare Drivers

You can easily track your miles and expenses, and download reports for tax time. This is essential because there are regular expenses related to food delivery services and rideshare driving, and Everlance eases the stress of tracking everything yourself.

Freelancers

Everlance is mainly marketed toward food delivery and rideshare drivers, but other types of freelancers can get a lot out of the app. You can track business expenses, income, and run tax reports.

Everlance Isn’t Best For:

Business Owners Who Need Route-Planning Features

While the Everlance app tracks your miles for you, it’s not helping you plan your routes.

Those Who Need Time Tracking Features

Everlance doesn’t offer any time tracking features, so it might not be best for self-employed people who bill hourly and need to keep track of their work times.

Is the Everlance App Worth It? The Final Word

Everlance is a solid tool for food delivery and rideshare drivers. Online reviews are overwhelmingly positive, and many drivers find the Premium plan ($5/month with a 7-day free trial) worth the cost because it automatically tracks your mileage with no limits.

Being able to track your miles and expenses is essential to making the proper deductions and tax time, and Everlance eases that need with tracking and tax reports.

FAQs

Everlance is a great option if you’re driving for work and want to keep track of your miles and expenses. You’ll definitely get the most out of the Premium plan because it offers unlimited automatic mileage tracking, whereas the free version only automatically tracks 30 trips per month. You have to manually enter them after that.

The Everlance app runs in the background while you drive and uses GPS technology to track your miles.

Yes, there is a free version of Everlance, and it lets you track 30 trips per month automatically. After you reach 30 trips, you can enter the rest automatically. There is also a free 7-day trial over Everlance Premium, which is $5/month, so you can see if it’s worth it before paying.

The Everlance app automatically detects where you’re at and uses GPS to start tracking your trips. It does this every time you drive with the app on, so you’ll need to go back and classify trips. As you classify trips, Everlance learns which ones are work and personal, and there’s not as much to classify.

DoorDash disclaimer:

- Earning more on certain types of orders (ex. alcohol): Earn more per order as compared to restaurant orders. Actual earnings may differ and depend on factors like number of deliveries you accept and complete, time of day, location, and any costs. Hourly pay is calculated using average Dasher payouts while on a delivery (from the time you accept an order until the time you drop it off) over a 90-day period and includes compensation from tips, peak pay, and other incentives.

- Get paid instantly (DasherDirect): Subject to approval

- Cash out daily (Fast Pay): Fees apply

- Start dashing today: Subject to background check and availability

- Dash anytime: Subject to availability