What if there was an app that put $5 aside into a savings account for you every time you published a Facebook status update? Well, it’s here… Qapital is one of the newest millennial-friendly automated savings apps that could legitimately change the way we save.

I was pretty excited when I first heard about Qapital because the premise itself is unique and very millennial-friendly. I also genuinely love finding new ways to help my readers save money.

But, with how different Qapital is – savings that are automated by triggers and rules, I wanted to spend some time giving you a full review that covers:

- What Qapital is

- How Qapital works

- The types of accounts Qapital offers

- Saving with triggers, rules, and roundups

- The cost of using Qapital

- How does the cost compare to other apps

- Frequently asked questions

- Will Qapital help me save money?

Table of Contents

- What is Qapital?

- How Qapital works

- The types of accounts Qapital offers

- Saving with triggers, rules, and roundups

- Round Up Rule

- Set & Forget

- Guilty Pleasure Rule

- Freelancer Rule

- Payday Rule

- Spend Less

- 52 Week Rule

- Apple Health Rule

- IFTTT Rule

- The cost of using Qapital

- How does the cost compare to other apps?

- Final word – will Qapital help me save money?

What is Qapital?

Qapital was developed in 2013 by two ex-bankers who saw a need for an app that challenged average savings habits. To fill that need, they created an app that accounted for each user’s unique personality and motivations. It’s part of behavioral economics and part micro savings app.

With Qapital, you are setting aside a bunch of really small amounts of money rather than less frequent big chunks. You can do this through roundups or automatic deposits. What really sets Qapital apart are the rules and triggers that “force” you into saving money without even noticing.

How Qapital works

To use QapitalQapital, you will need to pick from one of three different plans (I’ll cover pricing a little further down). Then you have to choose a funding source, which is the account Qapital pulls money from to put into savings.

Your funding account must be a bank account. It cannot be a credit card or PayPal account.

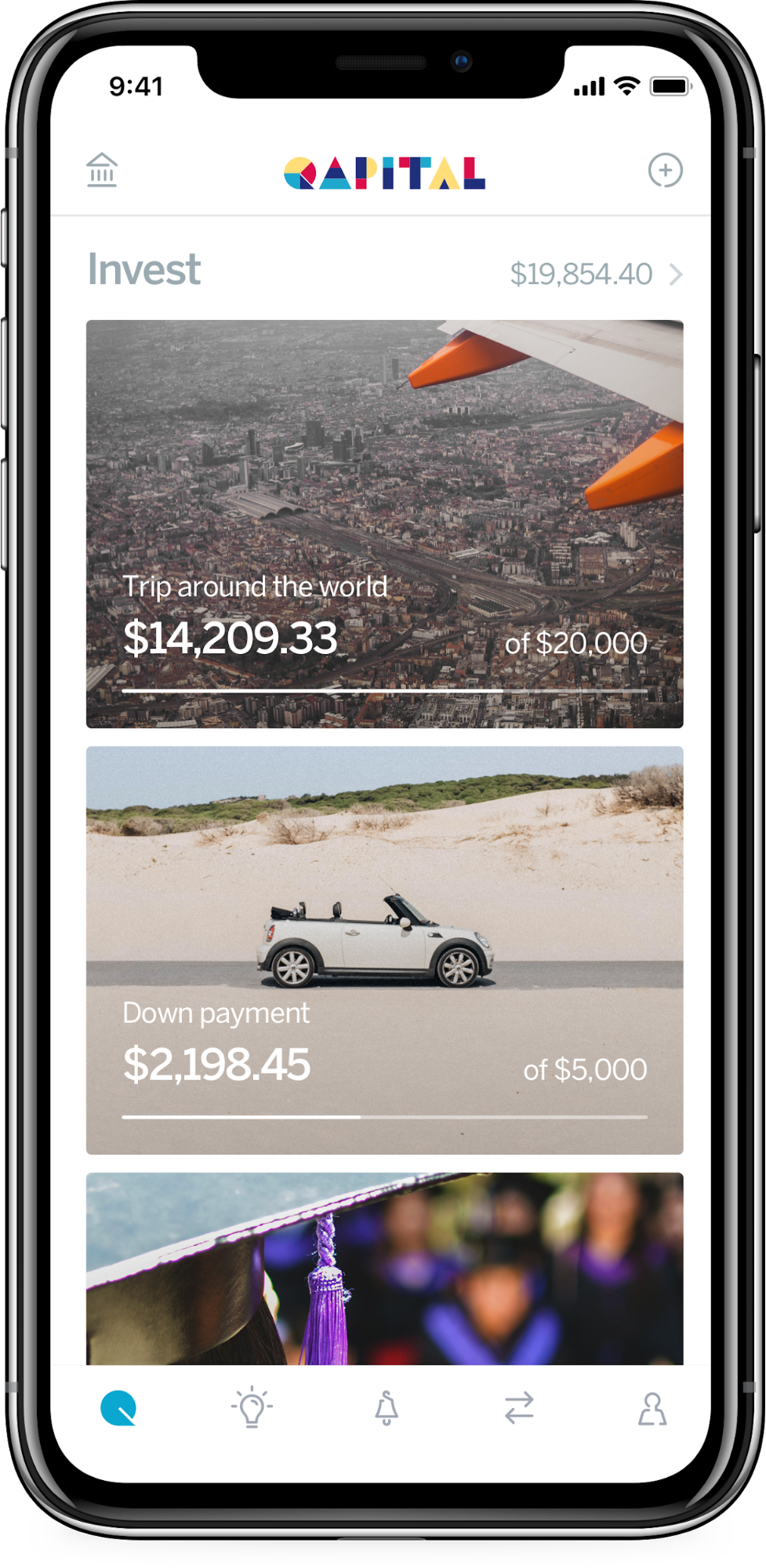

Then you set savings goals for things like:

- Save for a vacation

- Emergency fund

- Down payment on a house

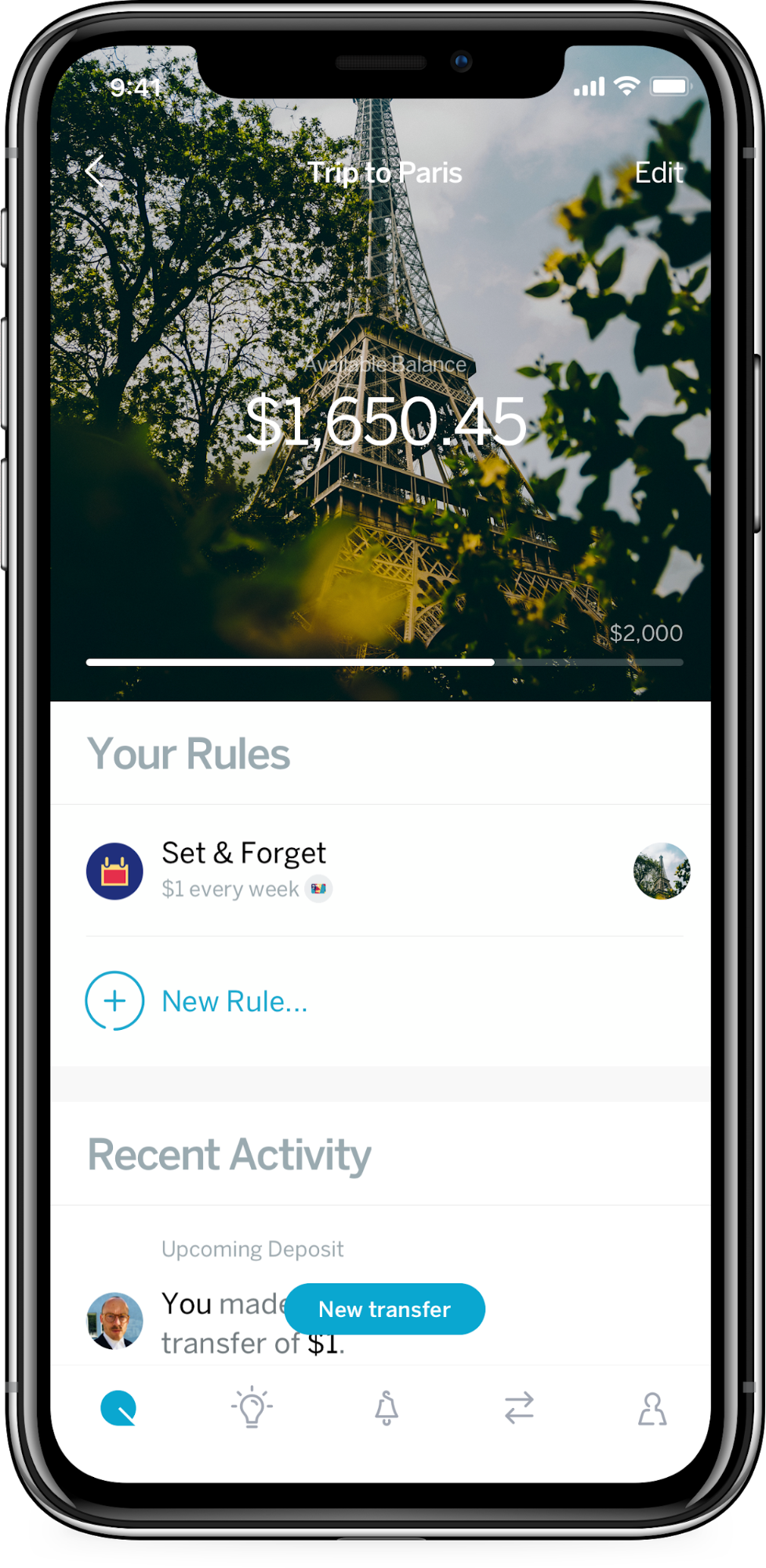

You can set any number of savings goals you want, and depending on your plan, you can save for them in a savings or investment account. You then set rules that automate your savings. You can link your PayPal and credit cards to those rules, not to fund those goals, but to set off certain triggers that tell Qapital to pull money from your bank account and put it into your Qapital savings account.

When you need the money you’ve saved, you can transfer it back to your bank account. Qapital is trying to make this easier with a dedicated Qapital Spending Account, which is a checking account set up through Qapital.

The types of accounts Qapital offers

These are the three different accounts available through Qapital:

- Goals Account – This is used for saving for different goals. You can save by yourself or save with a partner.

- Spending Account – This is a checking account that lets you access your money a little faster through a Qapital Visa Debit card.

- Invest Account – A diversified ETF portfolio for your long-term savings goals. Your portfolio is determined by what type of risk you’re comfortable with, and if you have different Invest Goals, you get an individual account for each.

Your money is held at one of their partner banks and is FDIC insured up to $250,000.

The way you save in those accounts is through roundups, automated deposits, rules, and triggers, and because those are probably the most interesting part of Qapital, let’s get to them…

Saving with triggers, rules, and roundups

You can use as many of these rules as you’d like, and if you have a tight week or month, you can pause them for up to 7 days or turn them off completely. That’s for individual rules or all of them.

Round Up Rule

This is pretty standard with micro savings apps, and the idea is that when you make a purchase from a linked bank or credit card account, Qapital rounds the transaction up to the next dollar amount. You choose the roundup amount, like $1, $2, $5, etc.

If you spend $4.37 on a latte and your round ups are set for $2, Qapital pulls an extra $1.63 and saves it for you.

Set & Forget

This rule tells Qapital to pull a set amount of money each day, week, or month. You choose the timing and the amount, and Qapital puts it into savings for you.

Guilty Pleasure Rule

If there is something you’re trying to avoid, like a certain store or restaurant, Qapital will pull money from your linked account if and when you do make a purchase there. You can set it for any merchant you want.

For whatever your guilty pleasure is, you set the merchant and amount saved. For example:

- Too much Taco Bell? Tell Qapital to save $5 every time you can’t resist a crunch wrap.

- Want to save every time you buy new golf equipment? Qapital can save $10 for you with each purchase you make from the pro shop.

This is an interesting concept because while saving is really good, this rule could feel like a punishment. Remember, saving money is never a punishment – it’s good financial health. If you choose to use the Guilty Pleasure Rule, remind yourself that you’re doing something that will benefit your long-term financial well-being.

Freelancer Rule

Because freelancers need to make sure they are saving up for estimated quarterly taxes, times when they have less work, etc., saving money is an extremely important part of this type of work. Qapital’s Freelancer Rule works on that premise by putting a certain amount of money into savings every time you get paid.

Just like the rest of the rules, you choose the amount and when it actually happens.

Payday Rule

This is basically the same rule as above, but it’s for people who aren’t freelancers.

Spend Less

Qapital isn’t really a budgeting app like Mint, but you can use the app to help you trim your budget and save more each month. Here’s how it works:

- Pick a merchant you’d like to spend less at each month

- Set the amount you have budgeted for that merchant

- Go under budget and Qapital saves the difference for you

For example: If you spend $20 less each month at Starbucks, Qapital will reward you by sticking that $20 into savings.

Learn more about budgeting with Mint at Personal Capital vs. Mint 2025: Which Money Tracking Tool is Best?

52 Week Rule

This rule sets you up to save $1,378.00 over the course of a year. There are two options for this rule:

- Save $1 on week 1, save $2 on week 2… $5 on week 5… $40 on week 40… all the way to 52 weeks of saving.

- Or, you can do this backward, starting with saving $52 on week 1, $51 on week 2, and so on for the rest of the year until you save $1 on week 52.

Apple Health Rule

If you use Apple Health, you can tell Qapital to save certain amounts of money when you reach different Apple Health goals. Do five workouts a week? Pay yourself $20 for doing so.

IFTTT Rule

I saved this one for last because it’s legitimately one of the most interesting parts of Qapital. The IFTTT Rule is a trigger rule that stands for “If This, Then This.” That means if you set a trigger and amount, Qapital saves that amount every time a certain thing happens. These are customizable triggers that are based on activity in apps like Google, Facebook, Instagram, Twitter, Spotify, your Fitbit, and more.

There tons of these IFTTT triggers, and Qapital continues to release new ones (adding new triggers is actually one of the triggers you can set). Here are a few more:

- Every time you take an Uber

- Every time it snows in your area

- When the Space Station passes over your house

- Every time you add a song to a Spotify playlist

- Save when the pollen count is high

- When you post a picture to Instagram

The cost of using Qapital

If you’ve gotten to this point in my Qapital review and are thinking “whoa, that’s interesting and I kind of want to try it,” then you need to know how much Qapital is going to cost you each month.

Up until November 2018, Qapital was free to use. They now have a three-tiered pricing structure:

- Basic $3/mo. This includes a Qapital Goals savings account, unlimited goals, and rules for triggering savings.

- Complete $6/mo. You get everything with Basic, but you can also get a Qapital Spending (checking) account and Invest account.

- Master $12/mo. Everything above, plus webinars, first access to new features, and Money Missions.

With Complete and Master, the money in your Qapital Goals account earns 0.1% interest, compounded monthly. This is not available with the Basic account.

Complete also comes with a couple of new features that offer more budgeting like functions – Payday Divvy and Spending Sweet Spot – and both of these are also included in the Master plan. Payday Divvy prompts you to asses transactions as needs or wants, using that information to put money aside for each. Spending Sweet Spot helps you create a budget and gives you insights on your spending habits.

Master comes with Money Missions, which is kind of vague term, but the idea is to create meaningful challenges that help you save money and enjoy the process. Qapital has worked with behavioral economists to come up with these missions.

How does the cost compare to other apps?

Qapital is on the higher end of other automated and/or micro savings apps, especially for the Complete and Master plans.

- Acorns is $3-$5/month

- Stash is $3-$9/month

- Digit is $2.99/month

- Twine is 0.60% of the money you have invested ($6/year per thousand dollars) and cash savings is free

At the same time, Qapital has way more functions to help you save. Qapital is the only one I’ve seen with IFTTT triggers. Twine is the only other one right now that lets you save jointly. But, Qapital is the only app with micro savings, micro investing, and budgeting capabilities.

For most people interested in Qapital, the Basic plan is going to have a lot to offer. You get the exciting rules and triggers. There isn’t an investment or checking account option, but you can try Qapital before you think about spending more.

Final word – will Qapital help me save money?

You know I can’t make any promises on that, but I do have some thoughts…

Automated savings apps like Qapital make it really freaking easy to save money, to the point that you might not even notice it’s happening. If you do notice it’s happening because of overdraft charges, then you might need more help than Qapital can offer.

Saving money takes creating habits, but it also takes sacrifices, cutting your spending, and/or making more money when you need to. If you need help with either of those, here are a few articles to check out:

- How to Save Money: Set Goals, Find Savings, and Make Big Things Happen

- How to Make $100 a Day: Step-by-Step Guide

- 40 Best 2025 Side Hustle Ideas (Make $1,000+ Per Month)

FAQs

This is a great question, and it’s a concern that people have about micro savings and micro investing apps that pull money from your bank account without you even noticing. Qapital does have a fail-safe in place – not withdrawing money from your bank account if there is less than $100 in it.

But, Qapital admits that this doesn’t work all of the time because of how ACH (automated clearinghouse) transfers work. You will have to keep track of your spending, and know the rules you’ve set to your account to avoid overdraft fees.

Deposits from your bank account to Qapital happen up to four times a week. They are batched together instead of having a bunch of them happen throughout the day.

If you have a goal you’d like to fund with a partner, you can invite someone to join you. You can both track your progress. An ideal goal would be if you and your partner are saving up for a vacation or a down payment on a house.

Here’s the thing about joint goals, once you’ve reached your goal, the primary Qapital account holder is the one who has access to the money.

Twine is an app meant for saving with a partner, and you can learn more at Twine App Review: Money Saving Solution for Couples.

The app doesn’t store information like your Social Security Number or bank login credentials. The app uses SSL and TLS encryption, and transactions between financial institutions happens on encrypted end points. When you open your account there is a verification process, and in addition to email/password login, you’re encouraged to set up a passcode and TouchID for Apple devices.

After you’ve funded a goal, Qapital automatically sets up another goal for you. They want you to keep the savings going.