At a Glance

FreshBooks is an easy-to-use accounting and invoicing software for independent contractors, freelancer, and small business owners who are just starting out. With an approachable price points, it’s a great tool to use to keep track of your business finances. However, there are limits to the number of clients and users that can present a roadblock for growing businesses.

Recommended for

- Independent contractors

- Freelancers

- Small business owners

What we like

- Strong invoicing

- Customer service

- Integrations

- User interface

What Needs Work

- Pricing

- Limits on clients and users

- No quarterly tax reports

Table of Contents

For small business owners and freelancers, you need an affordable and effective accounting system that makes it easy to keep up with payment deadlines, invoicing clients, preparing for tax time, and more. FreshBooks is accounting software designed to do just that, and its excellent user interface and features have made it a top pick for all different kinds of business owners.

This FreshBooks review is going to give you a closer look at features, how much FreshBooks cost, and the pros and cons of using FreshBooks, and FreshBooks alternatives.

FreshBooks Overview

FreshBooks is a web-based accounting solution that’s designed with small business owners and sole proprietors in mind. Since it was founded in 2003, FreshBooks has grown from invoicing software to a well-rounded and robust platform that includes double-entry accounting tools, client management, expense and mileage tracking, online payment processing, customizable invoices, reporting, and much more.

You’ll hear this in many FreshBooks reviews, but it really shines is when it comes to invoicing, customer service, reporting, and a clean user-interface. It’s also strong contender if you’re looking for an alternative to Quickbooks.

FreshBooks is 100% web based and there are both Android and iOS apps for mobile users.

FreshBooks Pricing

FreshBooks has four-tier pricing with monthly plans that start at $15/month. It occasionally runs sales that reduce the monthly price by 70%, and you can also save 10% by paying for FreshBooks annually. Lower tier plans offer fewer billable clients and features, but they are still a solid fit for new business owners.

FreshBooks offers a free trial on all plans and don’t require a credit card to get started. This gives you an easy way to test it out and see if it’s right for you.

All FreshBook plans include one user, and you can add additional users for $10/month. If you use Gusto for payroll, you can easily integrate it with FreshBooks.

FreshBooks Features

FreshBooks has a long list of features, but there a few we really want to highlight in this FreshBooks review because they’re the ones that really shine.

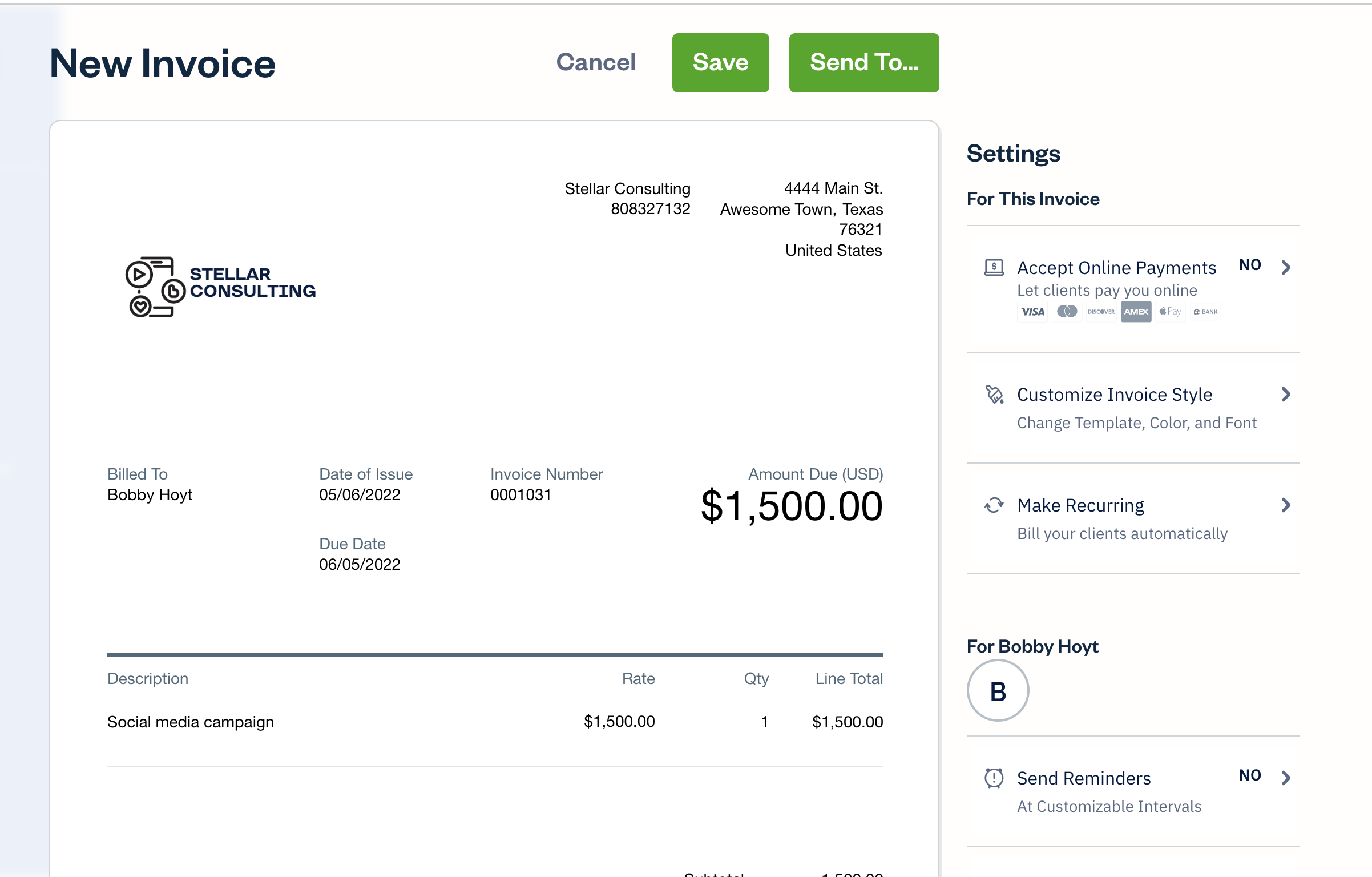

Invoicing

There’s a clear Invoice tab on your dashboard, and FreshBooks walks you through the steps of creating your first invoice. You can customize every invoice with your logo, and you can save templates to easily set up recurring invoices. The interface is incredibly clean, and you can click on any element and adjust it to your needs.

We also like how easy it to set your invoices to accept different types of online payments and to send reminders so your invoice doesn’t get overlooked. You can also see when the invoice has been viewed by your clients, so there’s no “But, I didn’t see it!”

Interface

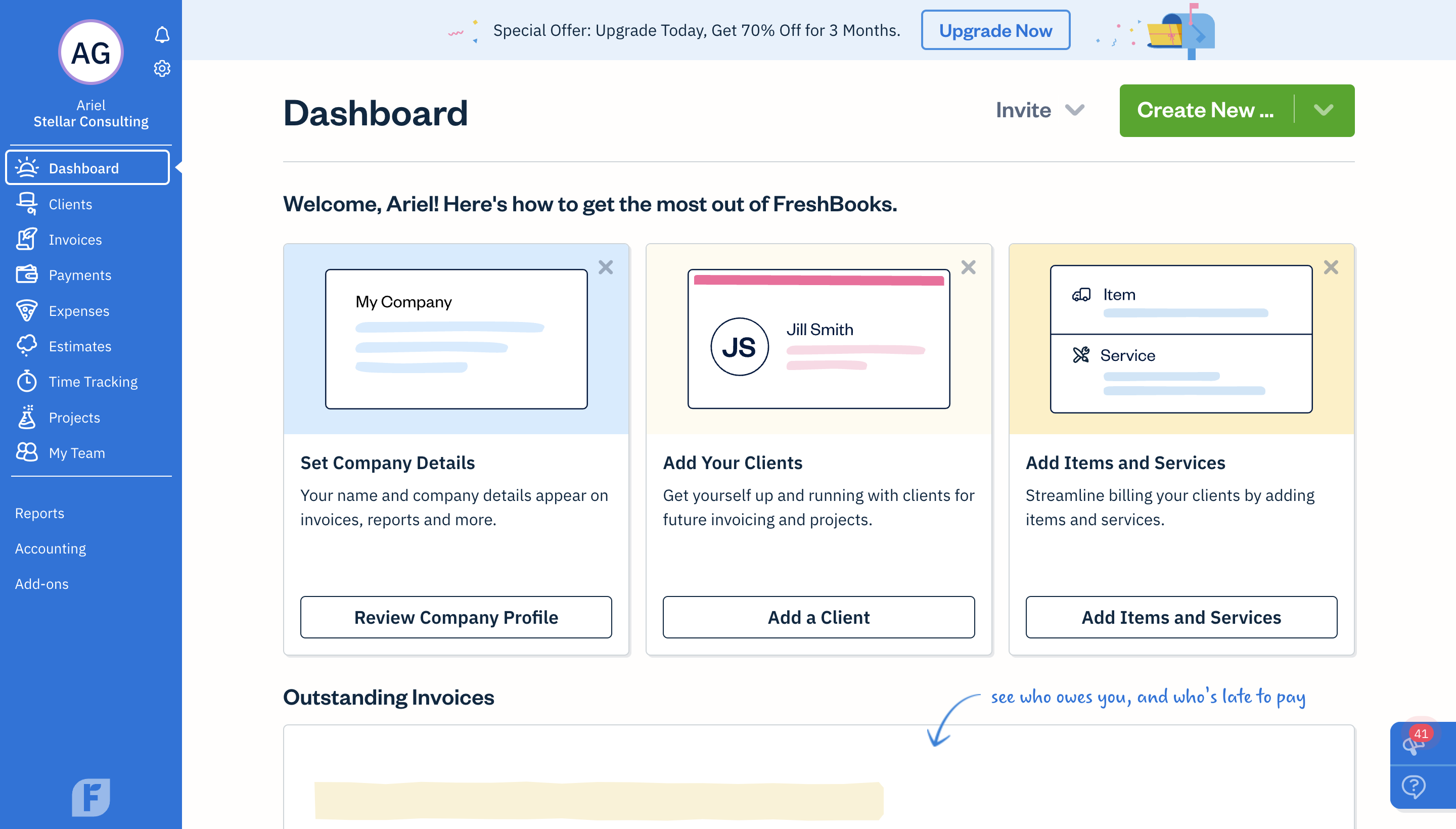

This has already been mentioned in our FreshBooks review, but the user interface really is clean and user friendly. Every time you log in, you’re brought to the FreshBooks dashboard. It’s not fussy or cluttered, and anytime you want to start using a new feature, there’s a quick start guide with arrows and instructions.

The initial set up of your dashboard happens during the onboarding process that helps you set up key features like your company’s profile, client database, and adding items and services. Those three things will make it easier to create invoices, accept payments, and so on.

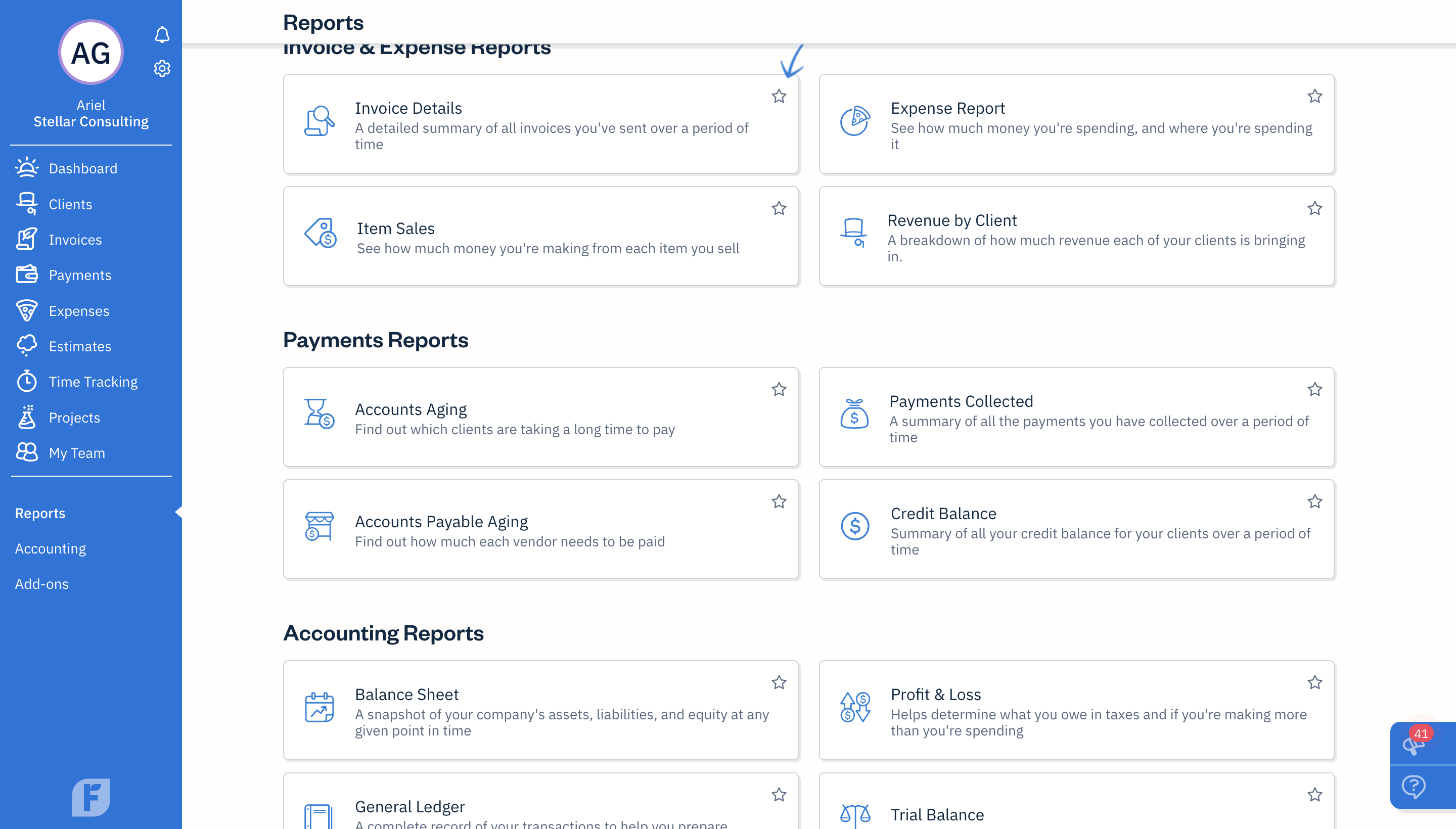

Reporting

To get the most out of FreshBook’s reporting functions, you will need the Plus ($25/month) plan or up. You can access invoicing and expense reports that break down payments by item type or client, and there’s the option to view clients by the time it takes for them to pay. There are also reporting options for profit and loss, a general ledger, payments collected, bank reconciliation summary, cash flow, sales tax summary, and so on. You can also drill down specific projects to look at profitability by service and expense categories.

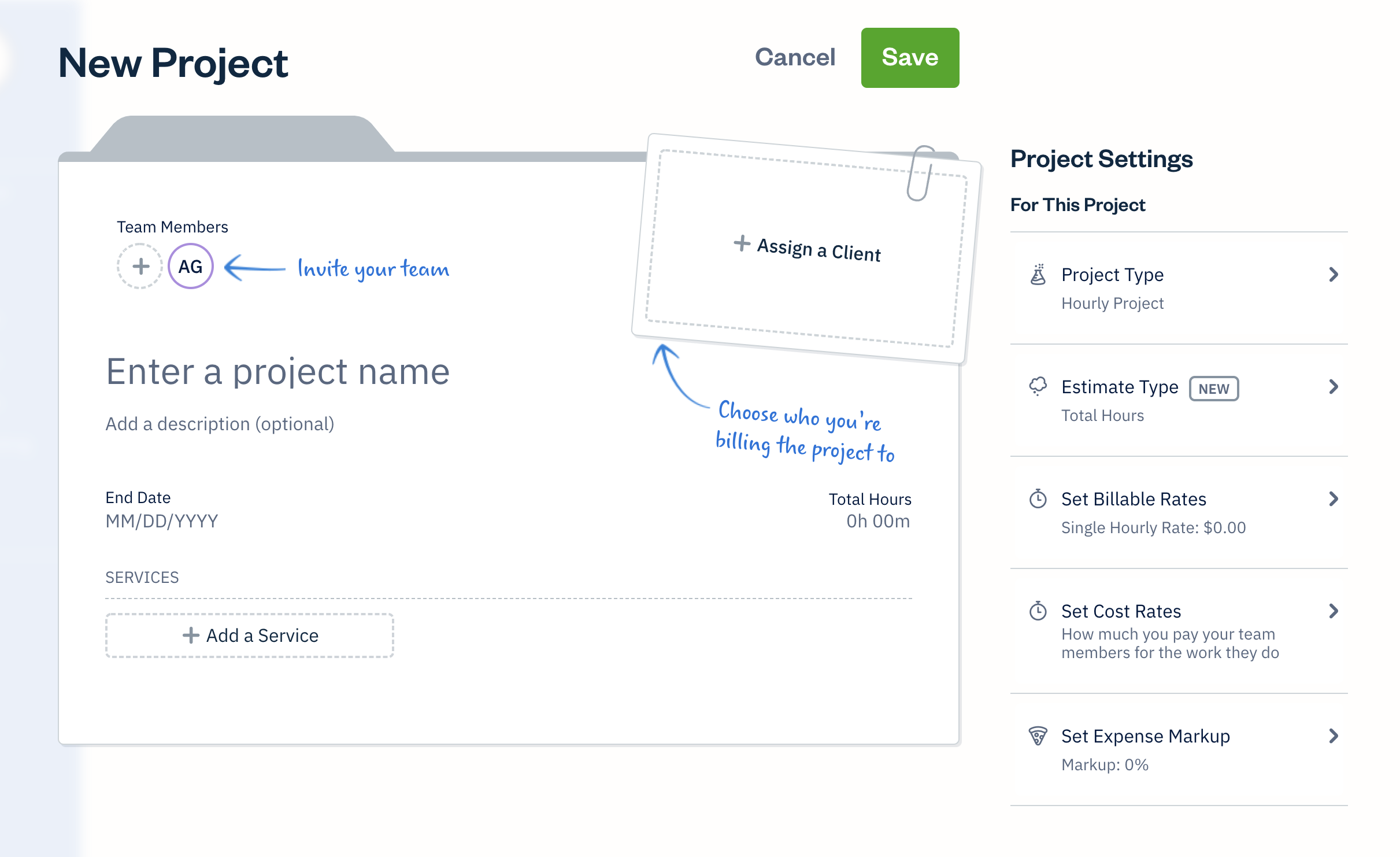

Project management tools

Overall, FreshBooks’ project management tools are simple compared to stand-alone project management software like Monday or Asana, but it’s likely enough for business owners who are interested in tracking expenses, progress, and profitability. It’s worth noting that Asana, Trello, Teamwork, and ProofHub all integrate directly with FreshBooks.

To start tracking projects, you will need to identify if it’s a flat rate or hourly project. FreshBooks pulls up a basic template to start tracking billable hours, services, and cost rates for you and your team. You can add team members and roles and set access restrictions to each. You can even assign projects to external clients if you’re outsourcing work.

Every project has its own overview where you can review progress and communicate with team members. You’ll be able to keep track of the projects profitability based on the number of hours your clients or freelancers bill.

Payment gateways and banking

Being able to connect financial institutions and set up payment gateways is essential to the functionality of FreshBooks. To set add your business bank account, you’ll need enter your login credentials, and FreshBooks will import account transactions. Depending on the financial institution, this takes anywhere from a few minutes to a few hours.

You can set up a gateway for clients and customers to make payments using FreshBooks’ own payment function. There’s a transaction fee of 2.9% plus 30¢ per transaction. This is comparable to PayPal and Stripe.

FreshBooks customer support

FreshBooks has several levels of customer support. If you run into issues, you can start by clicking on the Help Center button in the bottom right corner of the dashboard and search through a database of help articles. The same button will help you connect with a human. A chat bot triages issues and will connect you with a customer support representative via phone or email if necessary.

FreshBooks Pros and Cons

Pros

- Strong invoicing services: This is where FreshBooks stands out from other small business accounting software. It has a suite of invoicing features that allow you to create customizable designs, recurring invoices, receive instant updates about when your invoices are viewed and paid, and more. The FreshBooks mobile app makes it just as easy to access all of its invoicing functions so you can get paid and see where your customers stand even while you’re on the go.

- Customer service: Almost every FreshBooks review mentions its stellar customer service. The reason it’s so good is because of how quickly you can connect with a real human being. Emails are generally answered in 90 minutes and phone calls in approximately three rings. Having such fast, accessible service is a stand out (and necessary) feature when it comes to cloud-based accounting software.

- Integrations: FreshBooks flexible API means it can easily integrate with other software, including Gusto, Squarespace, Outlook, Dropbox, Slack, Trello, and 100+ other apps.

- User-friendly interface: FreshBooks has an inviting but simple design that makes it easy to start using. The newest update makes the overall design almost playful, while still offering a streamlined and focused platform. FreshBooks guides you through onboarding and any tool you’re first using.

Cons

- Pricing: We think the cost of FreshBooks is worth it for many small business owners, but it’s still hard to swallow $15/month+ pricing, especially when you consider the limits of the lower tiers (namely number of clients).

- Limits on users and clients: FreshBooks pricing is for one user, but you can add additional users for $10/month. Additionally, the lower tier plans limits you to 5 or 50 clients. This may not be a huge bummer for small businesses or sole-proprietors, but these limits don’t add a lot of scalability to the software unless you’re willing to pay $50+/month.

- No quarterly tax reports: You can run sales tax and expense reports on FreshBooks, but it doesn’t run quarterly tax reports like QuickBooks Self-Employed or Xero.

FreshBooks Alternatives

While FreshBooks is a solid web-based accounting software, it’s not for everyone. If you’re looking for alternatives, check out:

- QuickBooks Online: Starts at $25/month and is great for businesses with specific accounting needs while being easy to scale. You can read our full QuickBooks Onlinereview here.

- Wave: It’s limited but free, and there are add-ons to customize for your needs.

- Xero: Starts at $12/month and is a great choice for micro-business owners.

FreshBooks Review: The Final Word

FreshBooks offers robust accounting software for freelancers, solopreneurs, and small business owners. It really shines when it comes to invoicing, customer service, and its user interface. However, the user and client limits can make it a costly option if scaling is one of your short-terms goals.

The good news is that you can try FreshBooks for free without any commitments. You don’t even need to enter your credit card information. This gives you the chance to click around and check it out for yourself.

FAQs

The biggest disadvantage is that FreshBook limits the number of users and clients, especially in the low tier plans. And while it has strong reporting features, it doesn’t run quarterly tax reports that are necessary for many small business owners.

Yes, FreshBook is a 100% legitimate company that was founded in 2003 and has over 30 million users in 160+ countries.

It depends on what you’re looking for in accounting software. FreshBooks is generally better at invoicing and tracking expenses, while Xero has more capabilities for accounts payable.

Yes, Freshbooks has robust accounting tools that makes it a solid choice for your business bookkeeping.