Cash flow management is a tricky balance for some business owners. You’ve got expenses and debts to take care of, you need to be putting money aside for taxes, and you really should be paying yourself. The Profit First Method is a budgeting/behavioral system designed to help you balance it all.

I’ve recently implemented the Profit First Method in my two businesses, and I’m really excited about the potential. I’m also excited to share this methodology with other business owners who, like me, have struggled with cash flow in the past.

Table of Contents

The Profit First Method — Will it Really Keep Your Business Profitable?

What Is the Profit First Method?

The Profit First method comes from the Profit First book written by Mike Michalowicz. It’s a system where business owners take a percentage off the top of each sale as profit, and the company can spend what’s leftover on everything else.

You’re flipping the traditional profit formula that says you deduct expenses from sales and pay yourself with what’s left over. It sounds like an accounting model, but it’s actually a behavioral framework that forces you to rethink your spending habits.

Old framework: Sales – Expenses = Profit

Profit First method: Sales – Profit = Expenses

That equation appears to be the same, but flipping which comes first should ideally force business owners to be more innovative, think smarter, and be more resourceful.

Why do Profit First?

The Profit First Method is a behavioral framework based on something called Parkinson’s Law. The law was first used to describe the phenomenon that work somehow always expands to fill the available time, but it can also be applied to your business finances.

Michalowicz uses toothpaste as an example for Parkinson’s Law. When you open a new tube, you use it liberally. Big, fat globs of bright blue paste all over your toothbrush.

You don’t even care when you wet your toothbrush and half of that paste falls out the side.

It doesn’t matter because you have an entire tube of toothpaste to work with!

But what happens when you start to run out of toothpaste? You get real frugal real fast.

I’m sure there are some of you out there who have been known to literally cut the tube open and scrape out what’s inside. No shame in that!

In the toothpaste analogy your profits are the dregs left in the tube. You’ve probably spent a little carelessly at the beginning of the month, and now that the month is over, you’re quickly scrambling to make something happen for yourself.

But when you apply the Profit First method, you get even squeezes of toothpaste the entire month. You’re thinking about every spending decision you make and not wasting money.

You’re still using all of your funds (or toothpaste) but the output is better.

How to Implement the Profit First Method?

The Profit First method is a strategy used to manage all of your business finances, but you’ll start implementing it on a granular level.

Step 1: Set up 5 bank accounts

Each of these accounts serves an important function for your business, and it’s how you’ll allocate your cash:

- Income/revenue account

- Profit account

- Operating expenses

- Owner’s pay

- Tax account

Those are the 5 core accounts, and some businesses will decide they need more. But start with those 5.

Step 2: Determine your TAP

TAP stands for Target Allocation Percentages, and it’s where the magic starts to happen. You’ll follow TAP when allocating funds into each of those accounts I just mentioned.

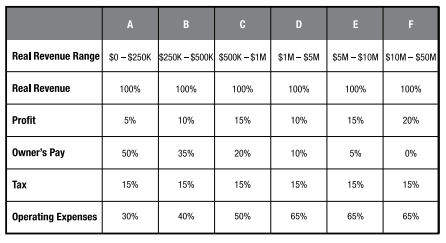

Every business owner is going to have slightly different TAPs, but to get an idea of where to start, Michalowicz refers you to this table:

You find where your business falls in the Real Revenue Range, and then you can follow the percentages down from there for your TAPs.

I want to stress again that this is subjective. Online businesses, for example, may have lower operating expenses because we aren’t paying for a physical location to run our business.

You also may not hit those numbers in your first month or two of implementing the Profit First Method. Remember, we’re talking about behavioral changes, and those don’t happen overnight.

Step 3: Transfer funds

All of your funds will go into your income account first, but you’ll need to establish a rhythm for transferring money out of that account and into the other four.

There’s no one-size-fits-all solution to when you do that, but Michalowicz suggests the 10/25 rhythm that he outlines in the book. That’s transferring money into those other accounts on the 10th and 25th of every month. He says it’s the best practice because it achieves a semi-monthly rhythm of accumulating money and then allocating it — called the cash flow wave.

But the Profit First Method is meant to be flexible. You can do it weekly, on the 12th and 27th, etc. Find a rhythm that works for you and stick to it!

The only thing to avoid is transferring funds more frequently than once a week because it becomes difficult to see your cash flow waves.

Details for the 5 Profit First Accounts

You’ll use 5 different accounts to implement the Profit First Method, but some people are a little confused on exactly what each of them does. Here’s a breakdown of each to clarify:

Income/revenue account

This account is only used for deposits of revenue, and you’ll use funds from this account to transfer to the other four accounts.

Profit account

Consider this a very small “off the top” account, and it generally receives the smallest percentage of funds. You can use money from this account for debt reduction, emergencies, and any kind of bonus you might pay yourself.

Operating expenses

This is all the money your business has available for operating expenses. If you have employees, you may want to consider a separate account for payroll. It ensures your team gets paid no matter what.

Owner’s pay

You’ll take your after-tax pay from this account. Some business owners are going to be tempted to reinvest their pay, but you need to get paid. This account will also cover any expenses that are fully for the owner’s benefit.

Tax account

Gotta pay taxes, and this is the account where you’ll save for taxes and any superannuation obligations.

Why Profit First Might Not Work For You

Spend any time online researching the Profit First method and you’ll come across two main complaints from CPAs or entrepreneurs who didn’t see the method work for them. These are valid points, and I want to go through why profit first fails for some business owners.

1. It kills growth

Some people feel that Profit First limits business growth by essentially putting a ceiling on how much revenue the business should generate. It’s like controlled growth instead of letting it naturally scale itself.

In the same vein, you’re being forced to take a salary when it might be better to invest that money back into your business. This is a concern faced by many new business owners, but I think it can also help you reach that five-year hurdle because you’re putting money aside for expenses, taxes, and gaining clarity on what kinds of expenses you can afford in the future.

The key is to get your percentages right and make sure you’re not too ambitious with any of your allocations.

2. It takes too many bank accounts

You’ll need to set up at least 5 separate accounts to make the system work, and that’s a lot of accounts for the average entrepreneur. Your bookkeeper also might go crazy with all of those accounts, but they’re necessary. This concern is two-fold because not all banks are compatible and some charge minimum balance fees.

Credit unions and online banks seem to be more Profit First friendly, and you can research options by looking for banks with sub accounts.

The Final Word on the Profit First Method

The Profit First Method is all about changing your mindset, and you will turn a profit if you follow it correctly. Now, there are also some limitations, and you can overcome those by making sure your TAP (target allocation percentages) are realistic and achievable.

I also believe that your goals should be evaluated yearly and changed — likely moved up — if you’re going to continue to expand your business.

The Profit First Method doesn’t replace the need for accounting — its cashflow management — but it can help you improve your business’s overall financial performance.

If you’re interested in learning more, grab the Profit First book here. Mike Michalowicz has a lot more to say and really does a great job explaining how the system works and how to implement it in a variety of scenarios.

FAQs

Credit unions, community banks, and online banks tend to work better. Look for banks that let you have sub accounts that don’t have minimum balance requirements.

This is described as the “come to Jesus” moment that some business owners may experience. The Profit First Method is very strict and says you may NOT use other money to cover expenses. You’re forced to reduce your costs and find a way to pay what you owe when the next allocation to your operating budget comes in.

No. You start allocating money the day you implement the method. That’s why it’s important to follow the steps outlined above — starting with setting up the accounts. You open those accounts and allocate money on the next deposit.

Minimum payments will come out of your operating expenses, and you should use anything left in that fund to pay off your smallest debt as fast as you can. Once you’ve paid off the smallest debt, you tackle the next smallest debt.

The Profit First Method takes Dave Ramsey’s approach to debt, or the snowball method. But there’s really no reason you couldn’t use the avalanche method of paying off the highest interest rate debt first — you may save money this way.