Unless you’ve been living under a rock or on a private island that lacks wifi (this sounds really nice right now), you’ve been bombarded with news about inflation, bear markets, recession…

It’s not just noise — these are serious issues that will affect real people — but there is something you can do to help protect yourself: invest in real estate.

Investing in real estate has long been seen as a hedge against inflation, and while there are still risks, commercial real estate is seen as a solid way to diversify your finances and to, hopefully, outpace inflation and come out ahead.

Table of Contents

A little history on inflation and U.S. real estate market

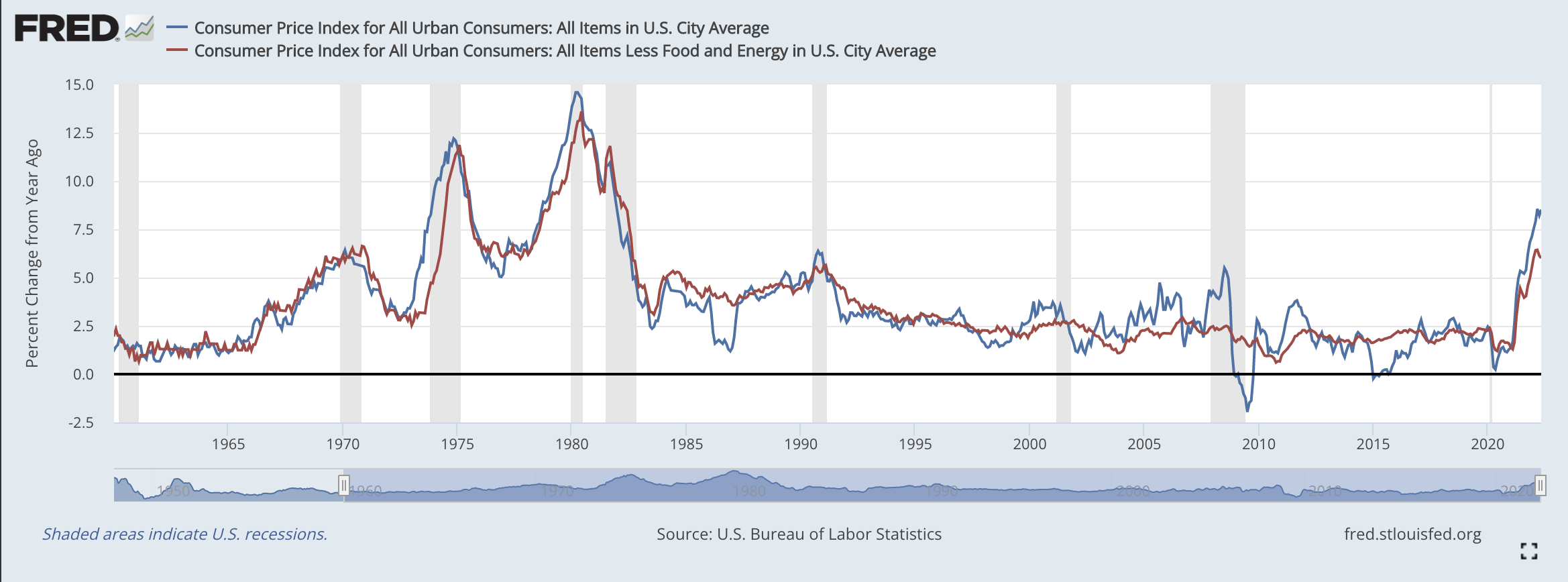

Not to minimize it, but inflation is a time-sensitive event. The U.S. has gone through periods of inflation, mostly war-related, going all the way back to the Revolutionary War. But the most recent and significant period of inflation is what’s known as The Great Inflation, which lasted from 1965 to 1982, shown on the chart below from the Federal Reserve.

There was a lot happening that led up to that 17-year period: an oil embargo, Watergate, the end of the Vietnam War, and a period of stagflation. However, it’s generally agreed upon that poor monetary policy is what caused such a long and tumultuous period, and it’s those decisions that’s led the Fed to quickly rates starting at the beginning of 2022.

Those 17 years were rough, but look at the period after that. From 1982 to 2021, which is nearly 40 years, there were small bouts of inflation (and we can’t forget The Great Recession), but it’s relatively even compared to those 17 years.

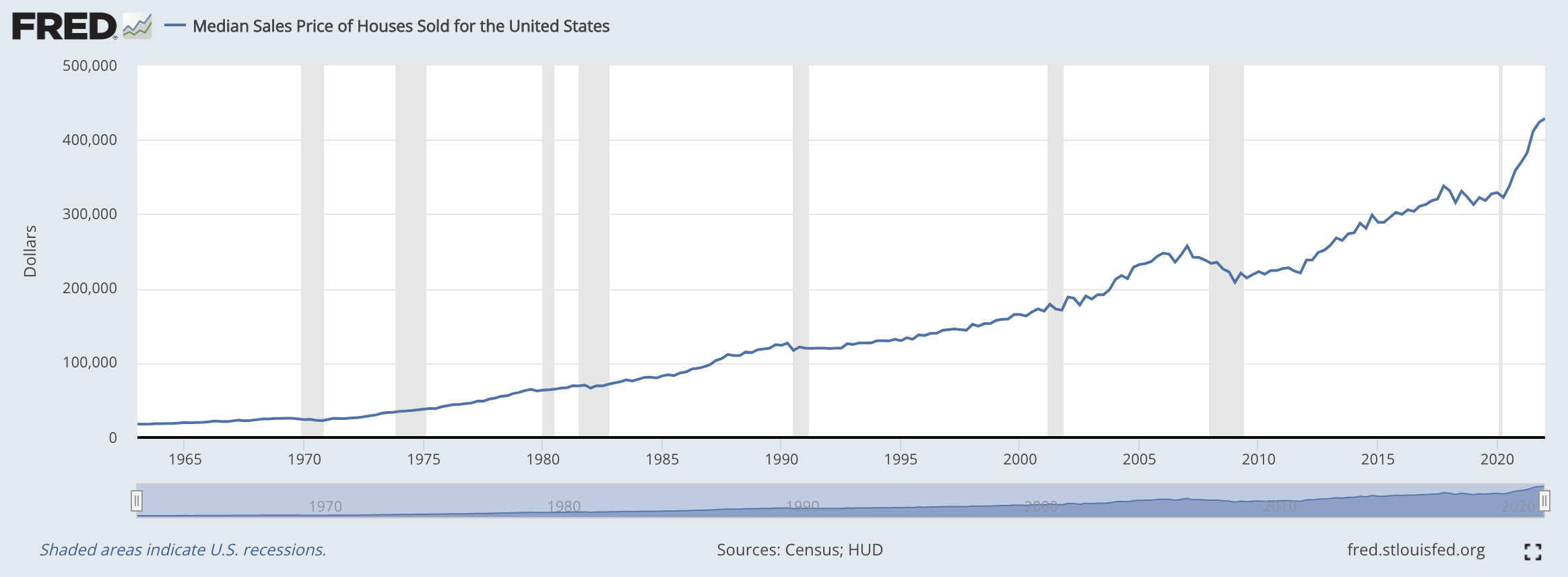

Now let’s look at the U.S. housing market, and this one may shock you:

During the same period as all of that inflationary volatility, the U.S. housing market has mostly been on an upward swing. Even during The Great Inflation, real estate value has been resilient and continued to gradually increase.

The important takeaway is that real estate and inflation operate mostly independent of one another, and that’s the main reason why expert investors turn to real estate as a hedge against inflation.

Real estate as a hedge against inflation

The commercial real estate market boomed in 2021 as inflation began to creep up beginning as early as January. In total, commercial real estate sales hit $809 billion for the year, which far exceed previous years. Real estate stocks, or REITs, were up 36% in 2021.

REITs (real estate investment trusts) were created back in 1960 as a way for average people to invest in commercial real estate (CRE) projects — think apartment complexes, major retail developments, and so on. They’re a good way to gain exposure to real estate while not actually buying a physical property. And since the 1970s (remember The Great Inflation is raging at this point), REITs have historically outpaced S&P 500 returns.

It would irresponsible not to bring up concerns about how unique factors, like recent fed rate hikes and the supply chain, could affect the commercial real estate market in the near future. However, commercial CRE has still been long seen as a cushion against inflation.

It’s REITs that are especially attractive right now because you’re investing in a diverse portfolio of income-producing real estate across a range of property sectors and regions. It’s very different than buying a house and flipping it, which is exposure to a single property in a single market.

REITs present a much lower barrier to entry than traditional real estate, and that’s the point. You no longer have to be an accredited investor, leverage your own home, or save up for years to invest in commercial real estate. You can literally invest in commercial real estate for as little as $10.

How REITs work

Most REITs have a fairly straightforward business model. The REIT leases space and collects rent and distributes the income to investors as dividends. Thinking about this in terms of hedging against inflation, while you may not be seeing stock market dividends, people still need places to live and work, therefore making rent and mortgage payments. But your investment is continuing to appreciate at the same time.

REITs are regulated, and the Internal Revenue Code created guidelines that a company must meet to become an REIT. You can invest in publicly traded REITs, including REIT mutual funds and ETFs, through brokerages like Robinhood or SoFi.

There are also private REITs through platforms like Fundrise that aren’t traded on a public exchange, therefore lacking some liquidity, but they benefit investors with a higher dividend yield.

4 Ways To Start Investing in Commercial Real Estate

1. Fundrise

Quick Facts About Fundrise

- Start investing for as little as $10

- Easy-to-use platform

- Redemption program to quickly sell back shares

- Available to non-accredited investors

- Strong investment transparency

Rating 4.6

Founded in 2012, Fundrise's main products are REITs, (or eREITs as Fundrise calls them) which generally invest in income producing properties like subdivisions, apartment complexes, and commercial properties. These are real estate projects across the U.S., in areas like the sunbelt, midwest, east coast, etc. There are also eFunds, which is where Fundrise pools investors money to buy land, develop housing, and sell it.

Investors purchase shares of eREITs or eFunds through one of Fundrise’s portfolios: Starter, Supplemental Income, Balance Investing, or Long-Term Growth. The mix of investments in each portfolio is determined by Fundrise to meet income goals.

Fundrise is known for low account minimums, and you can start investing in commercial real estate for as little as $10 with a Starter account. Unlike other platforms, you don’t have to be an accredited investor, which is a net worth and income requirement set by the IRS.

Investors pay fees of 1% annually, which is divided between a 0.15% annual advisory fee and a 0.85% annual asset management fee. Learn more in our Fundrise Review.

Invest in commercial real estate for $10

Fundrise offers an affordable alternative to traditional commercial real estate investing.

2. CrowdStreet

Quick Facts About CrowdStreet

- Available to accredited investors only

- Invest in individual projects or funds

- Large investment selection

- In-depth research

- Complex investments that vary by project

Rating 3.6

CrowdStreet is designed for accredited investors who want to add commercial real estate projects to their portfolio. All developers are vetted — including background and reference checks — by CrowdStreet before they’re added to the platform.

CrowdStreet investors can either pick and invest in individual properties on the platform or purchase CrowdStreet funds to invest in a broad range of projects — these funds are similar to how mutual funds work.

Each investment has its own minimum investment, but most require a minimum investment of $25,000. Fees vary by project, but CrowdStreet funds have a 0.50% to 2.5% annual fee based on investment capital. Read our full CrowdStreet Review for more information.

Want to generate passive income with real estate without all the work?

Accredited investors can get started investing in commercial real estate with a $25,000 minimum.

3. DiversyFund

Quick Facts About DiversyFund

- Available for non-accredited investors

- Invest for as little as $500

- Access to commercial real estate investing

- Only one REIT available

- Owns and operates all of its investment operates

Rating 3.0

DiversyFund offers non-accredited investors an entry into the world of commercial real estate with with as little as a $500 investment. Originally it took a minimum of $2,500 to invest with DiversyFund, but the SEC approved its change to lower the minimum investment back in $500, which is excellent for new real estate investors.

Overall, DiversyFund has far fewer options than CrowdStreet and Fundrise. There’s only one REIT available on site and includes multi-family and commercial properties across the U.S. But it’s unique in that DiversyFund owns and operates its properties, meaning managers have real skin in the game. The downside is that you can’t pick and choose your investments.

DiversyFund charges a 2% annual asset management fee, and other fees may apply.

Looking for a Yieldstreet and Fundrise alternative?

DiversyFund wants to create wealth for the everyday investor through chances to invest in apartment complex REITs.

4. Streitwise

Streitwise

- Open to accredited and non-accredited investors

- $5,000 minimum investment

- Redemptions available after first year

- One investment offering available at a time

Rating 3.0

Streitwise is sponsored and managed by Tryperion Partners, and it’s currently accepting accredited and non-accredited investors for a single private real estate investment trust that’s underway in St. Louis, MO and Indianapolis, IN.

The way Streitwise works is that you purchase a minimum of $5,000 worth of shares; each share is worth approximately $10, so 100 shares. Dividends are paid through investments, as in cash flow earned by collecting rents, but you also earn appreciation in the underlying assets. Dividends are automatically reinvested through a DRIP (dividend reinvestment program) that’s similar to what robo-advisors use.

The company requires that your investment cannot exceed 10% of your networth or income for the past two years. There’s a 3% upfront fee, followed by a 2% annual asset management fee, and there are no additional hidden fees.

Ready to invest in commercial real estate?

Streitwise requires a $5,000 minimum investment and has seen historic returns of at least 8%.

The final word on investing in real estate as a hedge against inflation

While there’s no magic pill that’s going to safeguard you 100%, there are definitely things you can do to protect yourself and your finances. Inflation is a scary thing, and there’s no telling exactly what’s going to happen in coming months, but research suggests that investing in real estate can be a solid hedge against inflation.

Anything you can do to diversify your investments is a excellent idea, and platforms like Fundrise give real people access to the world of commercial real estate.

Disclosure: We earn a commission for this endorsement of Fundrise.